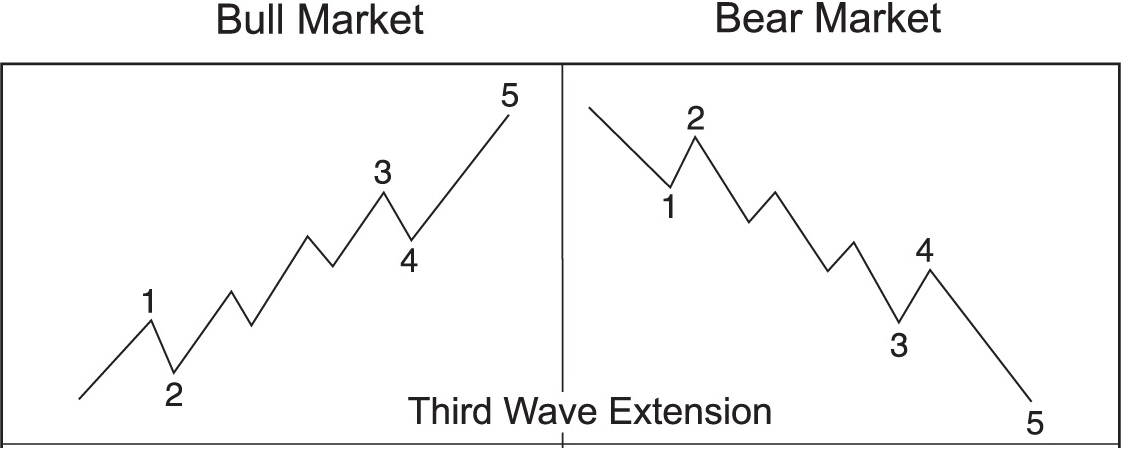

| “Third waves are wonders to behold. They are strong and broad. They usually generate the greatest volume and price movement and are most often the extended wave in a series.” — Elliott Wave Principle, Frost and Prechter, p. 78 Of the five waves in an Elliott impulse, the 3rd wave is the one you want to READ MORE |

| Are the Birds to Blame? Egg prices have skyrocketed. Is there another force at work besides the Avian flu? Read this analysis from Elliott Wave International’s Global Rates & Money Flows that you likely won’t find in the mainstream media: Commodity indices have a bullish tilt to them from a higher-degree Elliott wave perspective and READ MORE |

Elevate Your Elliott Wave Analysis

| Elevate Your Elliott Wave Analysis By Elliott Wave International RULES are great. They tell you what you can’t do. The Elliott Wave Principle has three. In a five-wave impulse (shown in the chart below): Wave 2 can never retrace more than 100% of wave 1 Wave 3 can never be the shortest of waves 1, READ MORE |

The Psychology of Elliott Waves

| “The Wave Principle” is Ralph Nelson Elliott’s discovery that social, or crowd, behavior trends and reverses in recognizable patterns. Elliott isolated patterns of directional movement, called waves, that recur in markets. These waves reflect mass psychological states. The two charts below summarize some of their characteristics. 12 Days, 12 Gifts to Help You Apply Elliott READ MORE |

Using the Elliott Wave Principle

| Five Benefits of Using the Elliott Wave Principle to Make Decisions While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the READ MORE |

Fireside Chat With Robert Prechter and Avi Gilburt

| “This is Going to Shock People!”: Avi Gilburt and Bob Prechter Chat “It’s going to make 2008 look like child’s play,” says ElliottWave Trader’s Avi Gilburt when discussing the precarious balance sheets of U.S. banks with Elliott Wave International’s Robert Prechter. In the just-released webinar “A Fireside Market Chat with Robert Prechter & Avi Gilburt,” READ MORE |

Gold Prices: The Calm Before a Record Run

| The basis for analysis and forecasting at Elliott Wave International is fundamentally different from everyone else’s. Here’s a prime example in gold. This excerpt is from the March Elliott Wave Financial Forecast, when gold was trading below $2,050/oz. Gold’s three-month implied volatility has declined to its lowest level in over four years. While low volatility READ MORE |

How to Read a Price Chart

| Want to Learn How to “Read” a Price Chart? Start Here. See how Elliott wave patterns “subsume” other technical analysis chart patterns Some investors who are fans of technical analysis may not realize that another way to look at many classic chart patterns — for example, Head and Shoulders — is to describe them in READ MORE |

Place Your Bets

| Are You a “Betting Man”? Then Take a Look — and Make Your Bet. I have spent much of my career among professional traders. By nature, traders are a betting crowd; if they can’t bet on the markets, they’ll bet on something else. A monthly highlight on trading floors was always the ‘NFP Sweepstake,’ where READ MORE |

Key Price Pattern

| FX, Stocks, Commodities, Cryptos… Learn How to Know When This Key Price Pattern is Over (Video) By Elliott Wave International “12345-ABC.” That’s a basic Elliott wave pattern in a nutshell. That “12345” is a so-called impulse, and it’s a key price pattern to know, because impulses point in the direction of the larger trend. In READ MORE |

New York Art Auctions Send a Hint

| What New York City’s Art Auctions Tell You About the Stock Market — and Social Mood The fall and spring auctions in New York City are the art market’s bellwether sales events. And according to The New York Times, the results from the City’s spring art auction season “tell a story of a masterpiece market READ MORE |

Commercial Real Estate

| Commercial Property Prices: Why the Decline May Have Just Started This index has already retreated 20% since May 2022 The major bust in property prices 15 to 20 years ago started with the residential real estate market. This time, the commercial real estate market may have taken the lead. Here are some recent headlines: [“Shark READ MORE |

Record Extreme in Stocks

| Stocks: What This “Record Extreme” May Be Signaling “The total easily exceeds the prior net long extreme” When most everyone agrees on the future trend of a market, it’s almost guaranteed that the market will go in the other direction — sooner rather than later. The reason why is that there is no one left READ MORE |

US Real Estate Owned by Investors

| U.S. Real Estate: A 24% Problem “…24% of U.S. single family homes are owned by investors.” A big reason that U.S. home prices have skyrocketed is that big investors like corporations did a lot of buying. As a Redfin.com headline noted nearly two years ago (Feb. 16, 2022): Real Estate Investors Are Buying a Record READ MORE |

Report on Commodities

| As Geopolitical Fires Obscure Commodities’ Path, This FREE Report Illuminates It! Crisis, crisis everywhere. But objective, free from the noise of the news, forecasting of commodity prices starts here, with our free Special Report ($155 value). The geopolitical landscape is wracked. War in Ukraine, humanitarian crisis in Syria, and now, what Vox Media on October READ MORE |