Why is Market Timing Necessary for Investing?

There are extended periods of time in the history of the stock market when buy and hold would not work.

For example, if you were planning to retire in 1930 and relied on your investment egg, you would be in for a big surprise. The market crashed and did not reach same level until almost 1954. If you bought at the top of 1929, 24 years would be a long time to buy and hold to break even in nominal prices.

|

DOW Jones Industrial Average Historic Prices 1929 – 2009 (Log Scale) – Buy and hold at your own peril

The market was flat in nominal prices from 1965 to 1982. But your money invested in 1965 would only have 10% of it’s purchasing power in 1982 due to high inflation. That would be a terrible disaster if you relied on that money for anything serious such as retirement.

Similarly, if you invested in late 1990s, you would be back to square one by the end of 2008 and the US dollars again failed to keep it’s value due to massive credit inflation bubble FED has been fostering.

There are many cycle theories such as Kondratiev Cycle, Elliott Wave Theory that try to explain these bubbles and busts. Understanding why they may happen is a good step so that we may be cautious in our financial decisions.

Does Diversification Work?

Will diversifying your investments help you now?

So what is this popular investment approach?

You’ve heard the answer before: Diversification.

You probably know that the purpose of diversification is to spread risk across asset classes. The assumption is that if one asset goes down, the others will be stable or perhaps even move up.

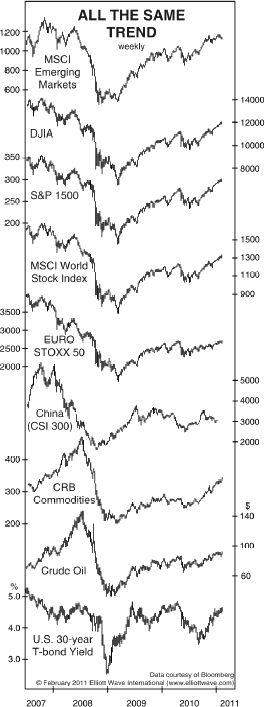

But what if we’re in a time when an “all the same market” scenario is unfolding in the financial world? What if the following description proves accurate:

“In recent years the financial markets have turned roughly together. Although to date they have not topped and bottomed on precisely the same day or even the same month (that would be too easy), their correspondence is getting tighter and tighter.”

Elliott Wave Theorist, May 2011

Please take a look at the chart below.

As noted in the quote above, not all financial markets are trending together exactly. Yet the chart speaks for itself: the correlation is becoming increasingly visible.

In the stocks category alone, diversifying between sectors can leave your portfolio beaten and tattered:

“More than ever on record, individual stocks in the Standard & Poor’s 500 Index are moving in unison…

“‘It’s not just stocks. It’s actually all asset classes,’ said [Andrew] Lo, who is…the chairman and chief investment strategist of a hedge fund. ‘The U.S. dollar relative to other currencies, gold, oil and hedge fund returns have now all become very highly correlated.'”

Huffingtonpost, (8/24)

No other investment approach has been more widely preached than “diversification.” It’s important to dispel the myth of diversification — especially now.

Let me introduce you to a free report called “Death to Diversification: What It Means to Your Investment Strategy.” Let me introduce you to a free report called “Death to Diversification: What It Means to Your Investment Strategy.”

This publication’s ten sections are packed with uncommon analysis which tells the truth about the too-common advice to diversify your investments. Moreover, the written analysis is accompanied by 18 fact-based charts. You can instantly access your free report after joining Club EWI. Club EWI is the world’s largest Elliott Wave Community with more than 325,000 members. It’s free to join with no strings attached We look forward to welcoming you as a Club EWI member. “Death to Diversification: What It Means to Your Investment Strategy“ can be on your computer screen in moments when you become a free member. |

The Big Picture – Historical Stock Market Returns

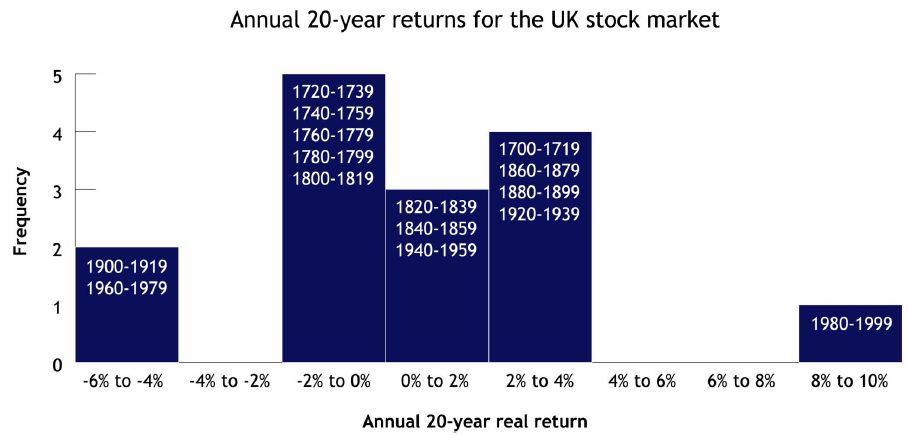

Below is a chart that shows the historic returns, adjusted for inflation, for the UK market for the last 200 years. It speaks for itself. It looks like a bell curve which shows the highest probable return for the stock market is -2% to +4%. If your 401k is long heavily in stocks based on common wisdom of this age, you may be betting that the 1 in 15 chance on the very right edge of the graph will happen again.

|

Source: http://seekingalpha.com/article/146891-triumph-of-the-market-realists#comment-641432

Buy and Hold is Dead

It was never alive. Buy and Hold was the common wisdom based on the bull market of 1980s and 1990s. That generation witnessed the bull market and along with the propaganda of mutual fund industry, they advertised buy and hold after the fact. We all heard the sales pitch:

If you miss the best 10 days of the market for the last 10 years, you will be left with pathetic returns. So it is best to stay invested at all times.

This claim may sound logical at first. But when you think about it, what are the chances that you will pick only 10 days to stay out of the market and those days will be the best days? The probability is probably less than being hit by a lightning.

The truth is if you stay out of the market, you will miss some good days as well as some bad days. The trick is to turn the odds in your favor. If you actually compute it, you will see that if you miss the best 10 days and the worst 10 days, you actually end up with better returns compared to buy and hold, at least in S&P 500 for the last 10, 20 years.

In general, if you have a strategy that allows you to stay in the market when it is more probable to go up, and stay out, or maybe short the market when it is more probable to go down, then you naturally make more money. Of course the mutual fund industry (and your 401k funds) do not want you to know this because they charge fees if you stay invested with them.

|

The old adage says, “you are what you eat,” and today we’re offering you a heaping portion of brain food.

At long last, the mainstream media is beginning to question buy-and-hold investing – it’s a myth that EWI’s original Independent Investor eBook debunked years ago. Even the “Efficient Market Hypothesis” has come under fire from the Oracle of Omaha himself – the Independent Investor long ago exposed EMH for the fantasy it is.

Now that the mainstream has finally caught up to these myths, the Independent Investor eBook can once again put you ahead of the herd; you can understand truths today that the mainstream will catch up to someday in the future.

You’ll get the most groundbreaking and eye-opening reports ever published in Elliott Wave International’s 30-year history, PLUS 6 brand-new chapters (43 new pages) of specific analysis, forecasts and commentary that will help you think independently in today’s tumultuous market.

Tens of thousands read the first Independent Investor, but even many of them will miss out on the important new advice the new, greatly expanded eBook imparts. Put yourself ahead of the herd for years to come – get a copy of the new 118-page Independent Investor eBook today.

Download the New Independent Investor eBook now. It’s FREE.

Market Myths Exposed eBook – Now Available

You’ve no doubt heard the old mantras “stocks for the long haul,” “diversify,” “buy and hold.”

Investment gurus worldwide repeat them daily ad naseum. But are they really wise investment strategies for ALL markets as advertised? Can any piece of advice that’s so simple yet so vague be of use to you as an investor?

Anyone who diversified their portfolios across several stocks, bonds and commodities over the past three years knows that diversification is no foolproof way to profit. The same goes for anyone who decided to buy and hold the S&P index 10 years ago — they’re 20% down even after the recent rally. Many individual stocks and commodities have performed much worse.

During the mania, when the trend was almost always up, virtually anything had a good chance to go higher. Investors ignored real safe-investment advice, because there was always someone lucking into a moon shot during the insanity. The S&P index itself – followed by the NASDAQ and other futures markets – sat at the center of the mania, and simply being in an index back then often outperformed other popular strategies. That’s all over with now.

Our friends over at Elliott Wave International have just released a brand-new ebook to help you sell and fold bad investment advice for forever. EWI’s 33-page Market Myths Exposed eBook takes the 10 most dangerous investment myths head on and exposes the truth about each in a way every investor can understand.

You will uncover important myths about the safety of your bank deposits, earnings reports, investing in bubbles, small stocks, inflation and deflation, speculation and more.

Please learn more about the 33-page Market Myths Exposed eBook, and download your copy now. Free Download!