The Dow Industrials’ Big 8-Wave Cycle is Incomplete

“We finally understand our full Elliott wave position”

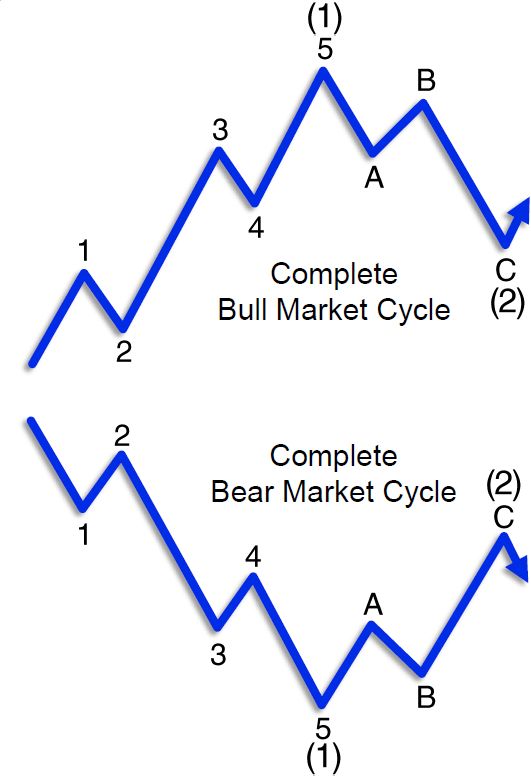

The Wave Principle’s basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves, as illustrated in both bull and bear markets below:

Keep in mind that the stock market is a fractal, so this pattern unfolds at all degrees of trend, whether the timeframe is 3 months, 3 years, 3 decades or 3 centuries.

As you might imagine, the size of countertrend corrections are in proportion to the size of the preceding five-wave move. In other words, a five-wave price move that took 3 decades to unfold will sport a much larger correction than a five-wave move that took 3 years to complete.

Here’s what you need to know: Elliott Wave International’s publications shown subscribers the complete, eight-wave cycle at all relevant degrees of trend, including the Grand Supercycle trend which began in the late 1600s.

For instance, after showing a price chart which began in 1697, the February 2021 Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and cultural trends, said:

[The chart] shows the market at the highest scale for which we have data. It comprises countless individual Elliott waves that have taken many generations to play out.

At this scale, we finally understand our full Elliott wave position.

Less than a year after that commentary, the Dow Industrials and S&P 500 index topped in January 2022.

As implied, that top may be far more significant than marking the end of the bull market which began in March 2009 and far more significant than many market observers believe.

Indeed, the sentiment expressed by two recent headlines from major mainstream publications is “buy the dip”:

- Stocks Have Been Falling. I’m Still Buying Steadily. (The New York Times, May 20)

- Don’t Panic. It’s Time to Be Bold and Buy Stocks. (Barron’s, May 13)

However, Elliott Wave International is emphasizing financial protection and safety.

The main reason for that stance is that the Dow’s centuries-long eight-wave bull market cycle (which, as you’ll recall from the illustration, includes three corrective waves) is incomplete, according to our analysts’ best interpretation of the wave structure.

Get more insights into Elliott waves by reading Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote:

[R.N.] Elliott himself never speculated on why the market’s essential form is five waves to progress and three waves to regress. He simply noted that that was what was happening. Does the essential form have to be five waves and three waves? Think about it and you will realize that this is the minimum requirement for, and therefore the most efficient method of, achieving both fluctuation and progress in linear movement. One wave does not allow fluctuation. The fewest subdivisions to create fluctuation is three waves. Three waves (of unqualified size) in both directions would not allow progress. To progress in one direction despite periods of regress, movements in that direction must be at least five waves, simply to cover more ground than the intervening three waves. While there could be more waves than that, the most efficient form of punctuated progress is 5-3, and nature typically follows the most efficient path.

If you’d like to read the entire online version of the book, you may do so for free once you join Club EWI, which is the world’s largest Elliott wave educational community (500,000 worldwide members and growing).

Club EWI members enjoy free access to a wealth of Elliott wave resources on financial markets, investing and trading. A Club EWI membership is also free.

Just follow this link to get started:Elliott Wave Principle: Key to Market Behavior – free and unlimited access.