History shows that the U.S. should pay attention to economies in Europe

The economy has been sluggish for five years. There’s no shortage of chatter about “why,” yet few observers mention deflation.

One exception is a hedge fund manager who spoke up at the recent Milken Institute Global Conference.

- The presentation by Dan Arbess, a partner at Perella Weinberg and chief investment officer at PWP Xerion Funds, was startling because of how deeply it broke from the standard narrative.

- We’ve been wrong to assume that the economic crisis is over, Arbess said. … The threat of deflation is once again rearing its head.

- “The persistent risk in our economy is deflation not inflation,” Arbess said.

CNBC, May 2

Deflation appears to be more than a threat. Consider what’s already happening in the U.S. and in Europe.

- Industrial production declined in April by the most in eight months, indicating American manufacturers will provide little support for an economy beset by weaker global markets and federal budget cuts.

- Bloomberg, May 15

- Europe is slipping further into recession.

- The euro zone economy shrank more than expected in the first three months of 2013 … as France returned to recession for the first time since 2009 and Germany barely edged forward.

- It marked the longest recession for the euro countries since the currency was introduced in 1999.

New York Times, May 15

Here’s a relevant fact: The Great Depression of 1929-1932 started in Europe before coming to America.

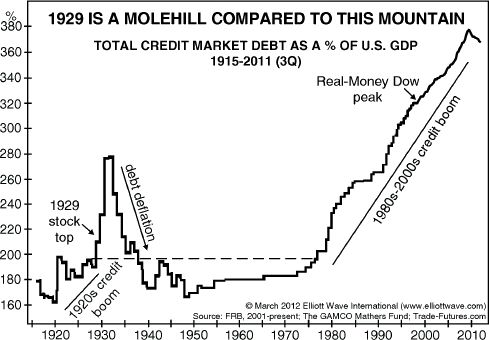

The economic wave may be much bigger this time.

Robert Prechter made this observation:

- Total credit will contract, so bank deposits will contract, so the supply of money will contract, all with the same degree of leverage with which they were initially expanded.

Conquer the Crash, second edition, p. 111

EWI published this chart in March 2012.

|

The enormous credit expansion that started in the early 1980s is due to be leveled.

You can prosper during the next economic contraction. Many people did just that during the Great Depression. Robert Prechter’s New York Times bestseller, Conquer the Crash, can teach you what you need to know to protect your portfolio during these high-risk financial times.

For a limited time, you can get part of Conquer the Crash for free. See below for more details.

|

8 Chapters of Conquer the Crash — FREEThis free, 42-page report can help you prepare for your financial future. You’ll get valuable lessons on what to do with your pension plan, what to do if you run a business, how to handle calling in loans and paying off debt and so much more.

Get Your FREE 8-Lesson “Conquer the Crash Collection” Now >> |

November 29, 2012

Despite good performance in the US stock market, European markets have been declining lately. It’s been over two years since the European Central Bank began its open-heart surgery of the eurozone’s anemic economy. So far, the procedure has included an unprecedented $3 trillion-plus in bailouts, monetary transfusions, AND toxic debt transplants.

Yet, according to a recent slew of discomforting news reports, the economies across the pond would still flatline in seconds without constant life support. Here, an April 18, 2012, Wall Street Journal writes:

- “Europe Hemorrhages through Refinancing Operation Band-Aid” and reveals that Europe’s banking sector has wolfed down three years of Long Term Refinancing Operations (LTROs) in under four months.

The question is: what went wrong?

Well, to answer this, we have to go back to the drawing board to mid-2010. It was then that the European Central Bank and company released the rescue-package Kraken via a $1 trillion bailout of Greece and a full-fledged initiation of its LTRO.

And, as the following May 10, 2010, news items make plain, this credit-reflating beast was set to tear Europe’s economic bear to shreds:

- “This is shock-and-awe, part II, in 3D, with a much bigger budget and more impressive array of special effects. The EU package eliminates the danger that Greece’s debt woes will ricochet through Europe’s banks.” (USA Today)

- “This is a truly overwhelming force and should be more than sufficient to stabilize markets, prevent panic and contain the risk of contagion.” (Bloomberg Businessweek)

In the July 2010 Global Market Perspective, however, our analysts foresaw a fatal flaw in the plan. The first part was fine: The European Central Bank (ECB) bought packages of debt and resold them to smaller banks at a historically low interest rate.

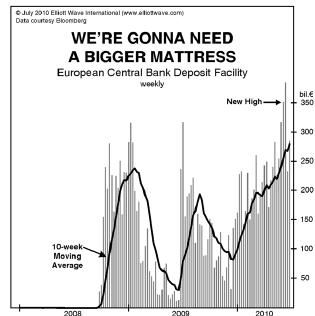

BUT the second part didn’t work out: Instead of rebundling those loans and passing them on to small businesses to stimulate investment, THOSE banks redeposited the funds with the ECB. Riffing off the famous “Jaws” quote (“We’re gonna need a bigger boat”), the July 2010 Global Market Perspective captured the great-white fear circling the lending sector via the following chart of commercial banks’ usage of the ECB’s Deposit Facility and wrote:

- “The chart roughly indicates the degree to which banks fear for the insolvency of one another. Banks receive below-market interest rates on their ECB deposits, so they’re generally loathe to hold significant funds there. As anxiety grows, however, so do banks’ deposits in the Facility, mainly because their desire for adequate interest gives way to their more essential need to safeguard principal … Because the “economic downturn” is still young, deposits at the ECB will likely keep rising. Like stocks, the casual approach to banking that existed up until now is in for a massive shift.”

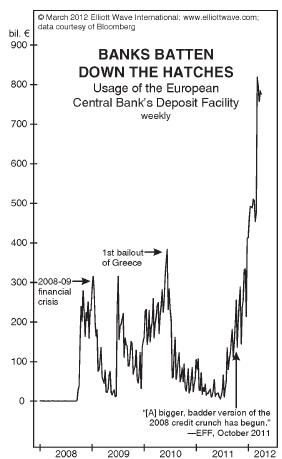

Flash two years ahead. The April 2012 Global Market Perspective’s updated chart below shows that usage of the ECB’s Deposit Facility has indeed risen, nay doubled, since the original forecast.

The question now is not whether monetary policy will save Europe’s economy, but whether the one precondition for recovery – confidence – will return to lenders.

|

What the European Debt Crisis Could Mean for YOUR InvestmentsThe European Debt Crisis is affecting investments across the globe. Gain a valuable perspective on the European debt crisis and get ahead of what is yet to come in this FREE club resource from Elliott Wave International. Do not be a victim of deflationary crash that might dwarf Great Depression.

Read Your Free Report Now: The European Debt Crisis and Your Investments |

What Happens in Europe Will Not Stay in Europe

More than 1,500 years after the fact, scholars still debate the causes of the Roman Empire’s fall.

What historians do agree on is that the crumbling empire’s final days were marked by economic contraction, a struggle to fund Rome’s routine affairs and excessive debt.

Sounds familiar?

Mark Twain said, “History doesn’t repeat itself, but it does rhyme.”

That quote seems to apply when economically comparing the Roman Empire and the United States.

Today’s superpower also faces a mountain of debt and a slow economy.

Unlikethen, however, the modern economy is global.

So an economic downturn in one major area of the globe is likely to affect another. In fact, even during the Great Depression (long before the phrase “global economy”), Europe was exporting to America.

But one historic export was not the kind that the U.S. welcome

The economy is clearly vulnerable to a debilitating wave of debt deflation. The threat is approaching quickly from an important source: Europe. The same sequence of events occurred in 1929, when deflation started overseas before lapping onto U.S. shores.

The Elliott Wave Financial Forecast, January 2012

The Financial Forecasthas long kept a careful eye on the threat Europe’s debt crisis poses to the U.S. economy.

The economic slowdown that EWFF characterized in January as Europe’s “top export” is finally reaching foreign shores. Several financial news outlets report that the U.S. and China are now “slipping in sync” with Europe.

The Financial Forecast, June 2012

And recent news registered the economic slowdown.

- Small Businesses Grow Wary; See Fewer Hires — Reuters, Oct. 9

- IMF Slashes Forecasts for Global Economic Growth — CNBC, Oct. 8

- World Bank Cuts East Asia GDP Outlook, Flags China Risks — Reuters, Oct. 7

- Europe’s Richer Regions Want Out — New York Times, Oct. 7

- Entrepreneurship is ‘weaker than ever’ — CNNMoney, Oct. 5

- The U.S. unemployment rate tumbled to 7.8% in September buta broader measure was flat at 14.7%.[emphasis added] – Wall Street Journal, Oct. 5

- Orders to U.S. Factories Plunge — Bloomberg, Oct. 4

- Spain’s Tax Take Tumbles as Companies Go Abroad — Reuters, Oct. 3

- Trade Slows Around World — Wall Street Journal, Oct. 1

Indeed, the European Central Bank recently initiated a new bond buying plan, the Bank of Japan just expanded its asset purchase and loan program, and the Federal Reserve announced QE3.

But don’t count on central bankers to rescue the global economy.

Consider what Robert Prechter said in the July 2012 Elliott Wave Theorist:

The Fed’s actions are short-term inflationary but are setting up a bigger crash than would happen otherwise.

Why do The Fed and other central banks around the world keep making these types of mistakes? You can find out for free. See below for details.

|

Take An Important Step Toward Understanding the Federal Reserve SystemIn the free 34-page eBook,Understanding the Fed, you’ll learn how the Federal Reserve controls the money supply, you’ll pin-point a few critical points in Federal Reserve history, and you’ll uncover several important myths and misconceptions, like who owns the Federal Reserve Bank.

This eye-opening report, which represents more than 10 years of research, goes beyond the Fed’s history and government mandate; it digs into the Fed’s real motivations for being the United States’ “lender of last resort.” Get your 34 page eBook now by creating your free Club EWI profile >> |

Few Americans realize that the Great Depression started in Europe.

Now as then, the global economy is fragile.

- The economy is clearly vulnerable to a debilitating wave of debt deflation. The threat is approaching quickly from an important source: Europe. The same sequence of events occurred in 1929, when deflation started overseas before lapping onto U.S. shores. In Germany, for instance, real GDP fell 1% in 1929 after growing 8.2% in 1927 and 2.8% in 1928. Other economic indicators peaked as early as 1927. At the time, economically-weak Germany was the equivalent of today’s so-called PIIGS (Portugal, Ireland, Italy, Greece and Spain).

Financial Forecast , January 2012

Lending in France also began to decline as early as 1927-28. And about a year before the October 1929 crash, net capital inflows fell in several European countries. In other words: European economies began to deteriorate before the Great Depression began in the U.S.

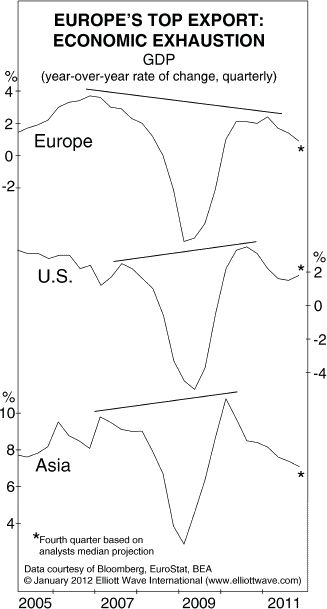

In Q4 of 2011, the eurozone was already nearing zero economic growth, vs. the U.S. and Asia:

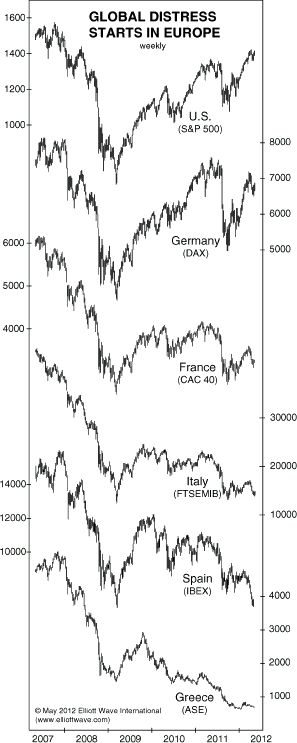

Also, a chart from our May 2012 Financial Forecast (data through May 3) shows European stock markets headed south before the S&P 500:

We know that deflation started in Europe just prior to the Great Depression; today the risk is “contagion.” With this in mind, consider the evidence that a deflationary trend may already be unfolding in the U.S. Here are some recent headlines:

- Illinois Faces 25% Cost Increase to Borrow $1.8 Billion — Bloomberg (4/30)

- States Scaling Back Worker Pensions to Save Money — Associated Press (5/1)

- Cash-Strapped NY Town Cancels July 4 Fireworks — WNBC-TV (5/9)

- Half of Detroit’s Streetlights May Go Out as City Shrinks — Bloomberg (5/24)

- CBO: Fiscal cliff likely to cause recession — CNNMoney (5/22)

- No ‘Barn Burner’ for Job Growth — CNBC (5/4)

- Student debt clock strikes $1 trillion — CBS Moneywatch (5/8)

- Shortfall in California’s Budget Swells to $16 Billion — New York Times (5/12)

- [Senator] Coburn: U.S. “going to get another downgrade” — CBS News (5/23)

- Home Prices Hint at Slow Housing Recovery — Wall Street Journal (5/29)

Here are recent headlines about Asia:

- Japan’s jobless rise stokes slowdown fear — Marketwatch (5/29)

- Hedge Funds Circle as Japan’s Asset Bubble Grows — Bloomberg (5/21)

- World Bank warns of China slowdown — CNNMoney (5/23)

Mounting evidence notwithstanding, most economists still say nothing about deflation. Then again, most economic observers were equally mute about deflation before the Great Depression.