“Bear Market Leader”? Here’s a Prime Candidate

This stock market sector has failed to recover since the Dow’s Q1 correction

As you may know, in every bull or bear market, some stocks or sector lead while others follow. So, the “leadership” in the stock market works both ways — in uptrends and down.

The rally in stocks since last November has been led by a relatively few big cap tech names, like Nvidia, Microsoft, Apple, Alphabet and Meta.

As you may also know, history shows that stocks which lead on the upside often lead on the downside after a market turn occurs. That’s why in our publications we’re keeping a close eye on the tech sector right now.

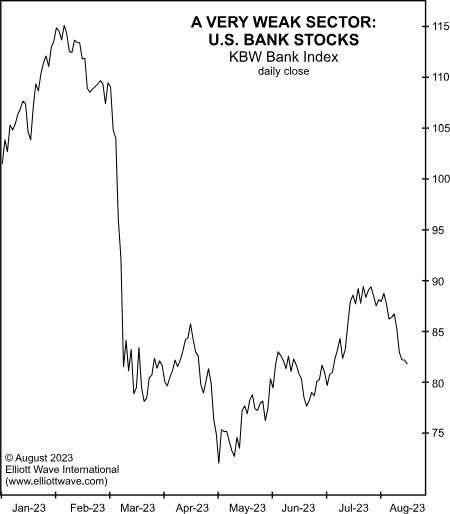

Another prime candidate as a bear market leader is the banking sector.

Indeed, the August Elliott Wave Theorist, a monthly publication which covers major financial and social trends, shows this chart and says:

Bankers are bullish on investments, but investors are not bullish on banks. Bank stocks turned weak during the Dow’s Q1 correction and have failed to recover with it since. While all the major stock market indexes rose into July-August, bank stocks stayed down on the year.

Besides sinking stock prices, banks are also grappling with an extraordinarily weak commercial real estate market.

As a June headline in The Financial Times noted:

US banks prepare for losses in rush for commercial property exit

As the article notes, some banks plan to sell off property loans at a discount even though borrowers have been making their payments on time. The reason for this is that banks fear more delinquencies in commercial real estate down the road.

U.S. banks hold about $2.9 trillion in commercial real estate loans, which prompted the Wall Street Journal to pose this question in July:

Is the Banking Crisis Over? We Are About to Find Out

As you might imagine, some banks are more vulnerable than others. And Elliott Wave International has emphasized time and again that it’s important for depositors to make sure they do business with only financially sound banks. Because even during a severe economic downturn, some banks will not only survive, but thrive.

As a 2022 Elliott Wave Theorist said:

The first edition of Conquer the Crash noted that depositors would become concerned about bank risks and move their money from weak banks to strong banks, making the weak banks weaker and the strong banks stronger. This is just what happened in 2008-2009.

The next financial crisis may be just around the corner.

Realize that major economic downturns generally follow severe downturns in the stock markets, so it’s important to keep an eye on the Elliott wave structure of the main stock indexes.

If you’re unfamiliar with Elliott wave analysis or simply need a reminder, read the definitive text on the subject, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter. Here’s a quote from this Wall Street classic:

The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Know that the online version of this Wall Street classic is available to you free once you sign up for a Club EWI membership. Club EWI is the world’s largest Elliott wave educational community and membership is also free with zero obligations. Members enjoy complimentary access to a wealth of Elliott wave resources on financial markets, trading and investing.

Just follow this link to get started: Elliott Wave Principle: Key to Market Behavior — get free and unlimited access.