| The basis for analysis and forecasting at Elliott Wave International is fundamentally different from everyone else’s. Here’s a prime example in gold. This excerpt is from the March Elliott Wave Financial Forecast, when gold was trading below $2,050/oz. Gold’s three-month implied volatility has declined to its lowest level in over four years. While low volatility READ MORE |

Category: Forex

Discussion about currency trading, gold, silver and commodities.

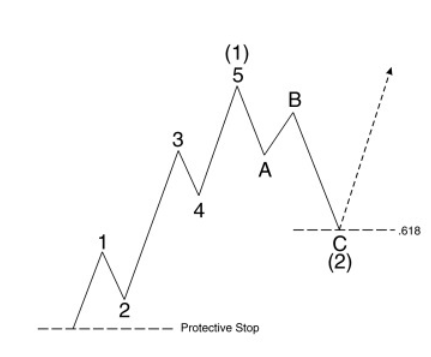

Key Price Pattern

| FX, Stocks, Commodities, Cryptos… Learn How to Know When This Key Price Pattern is Over (Video) By Elliott Wave International “12345-ABC.” That’s a basic Elliott wave pattern in a nutshell. That “12345” is a so-called impulse, and it’s a key price pattern to know, because impulses point in the direction of the larger trend. In READ MORE |

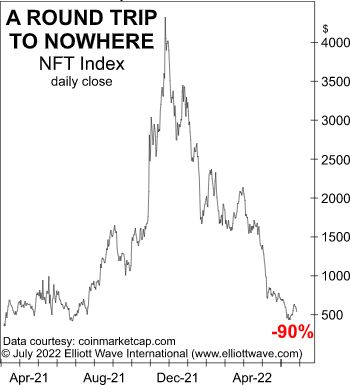

NFT Crash

| Non-Fungible Tokens (NFTs): Another Financial “Fumble” NFTs have taken “a round trip to nowhere” Tampa Bay Buccaneers’ quarterback Tom Brady is a non-fungible token (NFT) enthusiast. However, glory on the football field has not translated to this field of finance (Business Insider, August 8): Tom Brady bought a Bored Ape NFT for $430,000 in April. READ MORE |

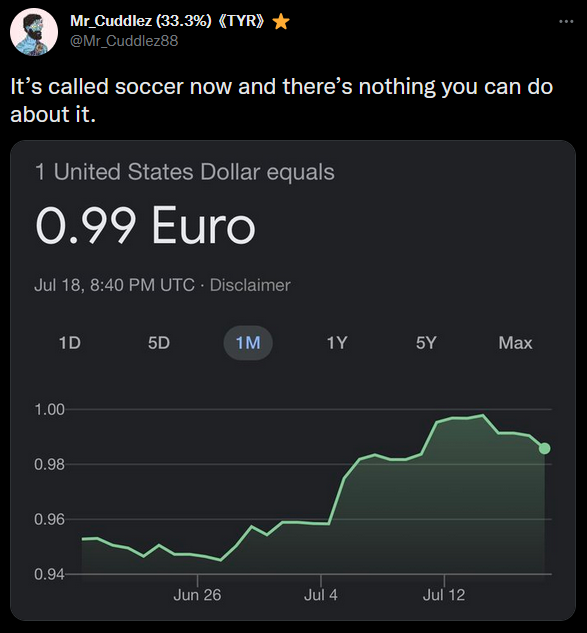

Euro is on Sale

| Europe On Sale: Get It While U Can On July 13 and 14, the euro and the U.S. dollar briefly traded at parity — for the first time in 20 years. Just 19 months ago, EURUSD was at $1.2350. It’s quietly dropped 20%+ since. Quietly? Yeah, because of all the other fireworks in the market READ MORE |

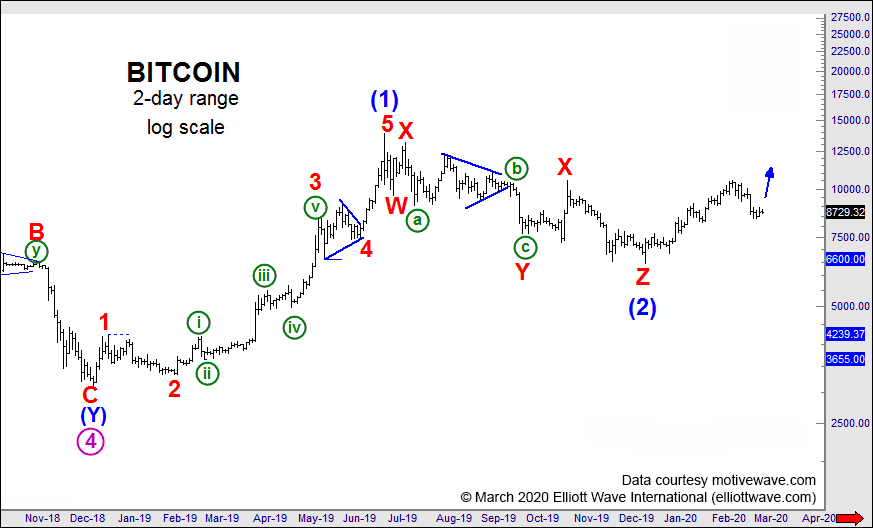

Bitcoin: More Volatility Directly Ahead?

| If there’s a single word to describe bitcoin’s price action, that word is “volatile.” Yet, those who invested roughly a year ago in the cryptocurrency — and stuck with it — have been hugely rewarded. (At least until very recently, as bitcoin traded more than 50% lower from its all-time high on May 19, as READ MORE |

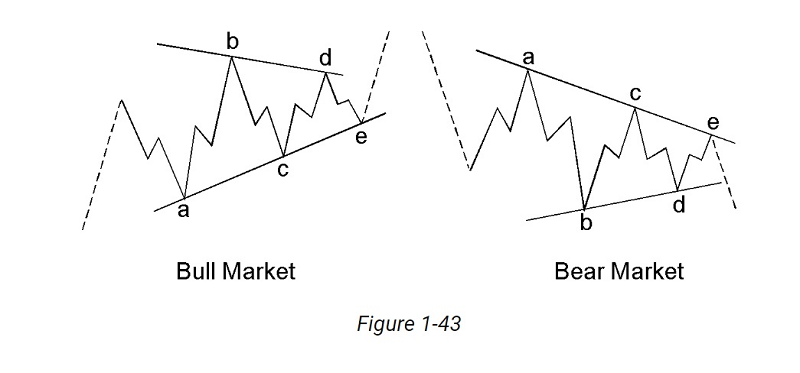

Gold From Boring to Six Year High

| As mainstream experts struggled to see the direction in gold, Elliott wave analysis saw a clear, bullish triangle. Then, gold prices rocketed to six-year highs! A common misconception of trading is that the best opportunities come near market highs and lows, when a change-in-trend is on the launchpad with 10 seconds to liftoff. The problem READ MORE |

Trading Crypto Currencies

| To Win, You Must Know Where You’re Wrong See how Elliott wave analysis helped traders reduce risk in Litecoin’s recent price action Dear readers, if a story about the get-rich-quick promises of cryptocurrency trading is what you seek, keep on moving. Rest assured, that story exists. It’s all over the interwebs, in one form or READ MORE |

Elliott Waves in Bitcoin Price Charts

| Bitcoin: Here’s Why the Push Above $20,000 Was in the Cards Now You Can Get Bitcoin Updates Daily and Even During the Day — and Get in Front of the Waves EWI’s FX analysts now provide cryptocurrency coverage. Now, investors who follow and trade Bitcoin can see what is most likely to happen next READ MORE |

Is the US Dollar Rally Coming?

| Down Dollar Down: Time for “UP”? Don’t rely on after-the-fact headlines. Our charts and forecasts explain how we got here — and where we’re going. Trading Forex: How the Elliott Wave Principle Can Boost Your Forex Success Learn how to put the power of the Wave Principle to work in your forex trading with READ MORE |

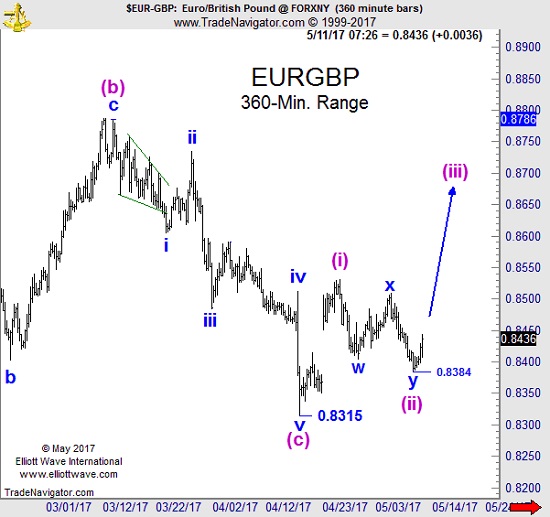

EURGBP: A Picture of Elliott Wave Precision

| The euro’s recent surge to two-month highs against the pound fit its Elliott wave blueprint beautifully Let’s assume financial markets are driven by news events. Negative news items cause prices to fall, while positive items fuel rallies. Easy enough, right? Not exactly. See, there are several problems with this premise, most of all this: Investors’ READ MORE |

EURUSD – What is Next?

| Think the recent rally in the euro was the result of “good news” from Greece? Think again. Watch our Currency Pro Service editor, Jim Martens, explain what’s really behind the moves. “Trading Forex: How the Elliott Wave Principle Can Boost Your Forex Success” In this free 14-page eBook, our Senior Currency Strategist Jim Martens pulls READ MORE |

Greek Tragedy? Too Late to Prepare

| Today, I got on the phone with Brian Whitmer, editor of our monthly European Financial Forecast. Brian has been preparing his subscribers for the Greek crisis for a while. Listen to his latest thoughts. Europe is in the world spotlight this month, with Greece’s future hanging in the balance. But Greece is just one part READ MORE |

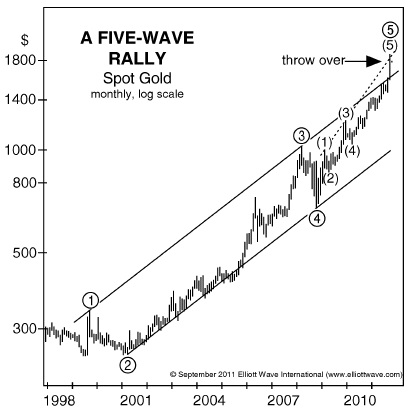

Gold Price Direction

| Where is the gold price heading? Will gold keep crashing? Since hitting a record high of $1921.50 per ounce in September 2011, gold prices have erased 30% in value. By the end of day on October 3, 2014, gold prices were circling the drain of a 15-month low. After such devastation, the global community of READ MORE |

Using Elliott Wave Analysis for Forex

| Analyzing Forex with Elliott Wave Can Help You Catch Rallies and Declines Free Week of Elliott Wave International’s Currency Specialty Service is here until Nov. 18, 2010 On November 1, the EUR/USD — the euro-dollar exchange rate and the most actively-traded forex pair — was trading the $1.38 range, near the level it is today. READ MORE |

Does Gold Always Go Up in Recessions?

| Gold: Best Supporting Role In Economic Downturns? Think Again Gold’s safe-haven status is based on hype, not history By Nico Isaac As I sat down to watch the Oscar pre-show on Sunday night, March 7, one word was repeatedly used to describe the celebrity starlets and their designer duds: GOLD. Gold bustiers and gold lame READ MORE |