Ponzi Scheme Called The Banking System

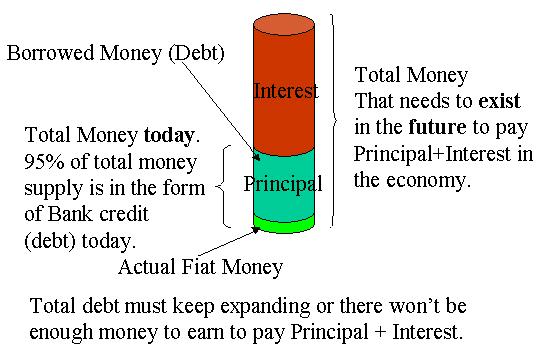

When banks give out loans, they do not give out money that they already have. They simply give the loan which is a promise to pay the actual money which they never really have to do. In the economy, 95% of the money is in the form of bank credit. There is no real currency backing it.

Whenever we borrow money, the bank creates new money. This process constantly (almost) expands the money supply. This dilutes the value of the existing money. This is because total debt has to keep expanding in order for people to be able to pay back what they owe, otherwise there simply won’t be enough money to earn to pay back what we owe. When that happens, we declare bankruptcy, there are foreclosures, unemployment and so on which causes the vicious cycle of deflation.

|

Current credit based monetary system is a game of musical chairs. As long as the music keeps playing (as long as total debt keeps increasing), system keeps running. The moment debt expansion stops (credit expansion stops), then money creation stops and it becomes impossible to pay existing debt (principal + interest) with the existing credit expanded (~existing money), thus some of us are guaranteed to go bankrupt (standing when the music stops). This is because there simply is not enough money in existence to pay the existing debt principal + interest. An interest free monetary system may be the fix.

To understand deflation better, read this free deflation report:

How Do Banks Create Money Out of Thin Air

Bank of England – Money Creation in Modern Economy – pdf.

Accounting details – Here is a video that explains how a bank makes loans in Fractional Reserve Banking and how a bank can get into trouble:

Current Financial Crisis – Credit Bubble

Ellen Brown presents the facts that lead to the financial crash. How banks create money, inflate the credit supply and how the system crumbles under it’s own weight.

Part 1:

Part 2:

Part 3:

Part 4:

Part 5:

Charging interest is bad for the society

As explained above, mathematically, we understand that the existing credit based system, with it’s ever expanding interest demand, can cause deflation and guaranties bankruptcies. The practice of constantly expanding the money supply steals from the savings of honest earners who want to use money as a store of value. Ordinary people should not need a Ph.D. in finance to figure out where to put their savings. Money, however it is defined, should be able to do that job in an uncomplicated way.

Most of us are conditioned to “make money work for us”. It is common wisdom to expect some interest for your money. Adam Smith claimed when individuals maximize their gains, that would ultimately serve the society and move it forward. This is not always the case. Here we have displayed why credit based monetary system that uses interest as a vital component falls short of satisfying the society’s needs. It creates conditions in which the human productivity is curtailed and focused on financial gain instead of supplying the necessities of life. Real economy is being burdened by a large financial economy that has to live off of the effort of the real economy.

Good for one, Bad for All

Religions (notably Islam today, Christianity earlier) forbid the practice of usury. There seems to be valid reasons for this and some think that we need to devise a new system to correct our wrongs. However, until then you need to know the dangers of the current system and operate accordingly (Threat of inflation, deflation, unemployment, risk of default, currency devaluation, business cycles to name a few).

Here are observations from the society where maximizing one individual’s gain hurts the society.

Sex Selection

In some cultures (India, China), parents prefer a male child. This is because a female child eventually requires the parents to pay a dowry, and the male carries the family name. Thus, to maximize their own good, parents decide to end pregnancies for a female baby, and keep male babies. This eventually brings an imbalance in male / female population ratio such that some males are not able to “carry on the family name” because they cannot find a bride to marry.

Wal-Mart

Wal-Mart is the store that has the lowest prices. To optimize our own gain, we go and shop there. But it comes with a price. It brings lower wages to the community. Workers have less benefits. Wal-Mart may cause other competitors close down their doors causing unemployment in your community. It will have ripple effects. Therefore, in this example, even though we maximize our personal gain in the immediate future, it effects the community in a negative way.

The Tragedy of the Commons

Here is a story by Garrett Hardin, in his essay “The Tragedy of the Commons, 1968”.

There is a pasture owned in common by the residents of a village. The pasture is at full capacity with regard to the number of the sheep the villagers have. It is such that if villagers add one more sheep, it will start degrading the pasture.

With their natural greed and an urge to maximize individual gain, each villager thinks if he adds one more sheep he will make more money. Thus they keep doing this. As they see the pasture land loose it’s productivity, their mentality will be “it is dead anyway, we should get what ever we can” and keep adding sheep as much as possible. This brings them to a state where the pasture will be damaged threatening their entire flock with devastating losses. It would be prudent for them to agree on a balanced production capacity and limit themselves and police the community to make sure everybody obeys. If not policed, volunteers will be hurt by others who grab their share. Thus, volunteering does not work in these cases.

This story is similar to the loan interest situation. Some volunteers may deny doing business with interest. But this is not enough to save the society. Law must forbid interest or it won’t work.

Paying Off Debt

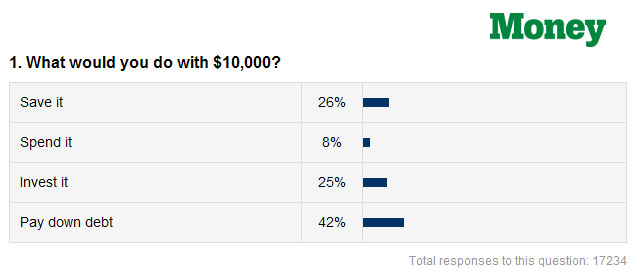

Here is a poll, from September 4, 2009 CNN Money:

|

In light of the above videos, this chart sums up the mood. People are trying to pay off debt. Since our entire money supply is borrowed money, when we pay it off, the money supply shrinks. This is why FED is trying to print money to counter the deflationary forces. That will probably have bad inflationary effects later down the road. But for now, we are heading into deflation. The credit bubble is shrinking. The deflationary effects of a slowdown in borrowing is explained here.

How does the ponzi scheme last?

Banks operate with the implicit guarantee of the FED and with the threat of “too big to fail” they blackmail the congress and get bailed out by the tax payer. The bankers know the system will fail again and again. But if they take precaution, they will loose money. Instead they take maximum risk and cause the bubbles as big as possible so that they have to be bailed out at tax payer expense!

Part I

Part II