Investing: What You Can Learn from Mom and Pop

“The highest commitment to stocks since the record levels of early 2000”

We all love Mom and Pop and cherish the valuable lessons about life they’ve given us along the way.

Yet, when it comes to investing, Mom and Pop may need to learn some lessons of their own.

Keep in mind that the American Association of Individual Investors’ (AAII) weekly survey is said to be representative of “Mom and Pop” investors, well-known for being quite cautious.

The August 2021 Elliott Wave Financial Forecast, a publication which provides analysis of major U.S. financial markets, discussed their behavior as the stock market was staging a significant rally:

In July [2021], the five-month average AAII stock allocation increased to 70.6%, a high level for this normally skittish cohort of investors. … This is the highest commitment to stocks since the record levels of early 2000.

This sentiment indicator is not meant for precision market timing, and, indeed, it seemed like these normally cautious investors had made the right decision. The rally persisted for the remainder of 2021. But, by early January 2022, the Dow Industrials and S&P 500 hit their all-time highs and have traded lower since.

What does this have to do with today?

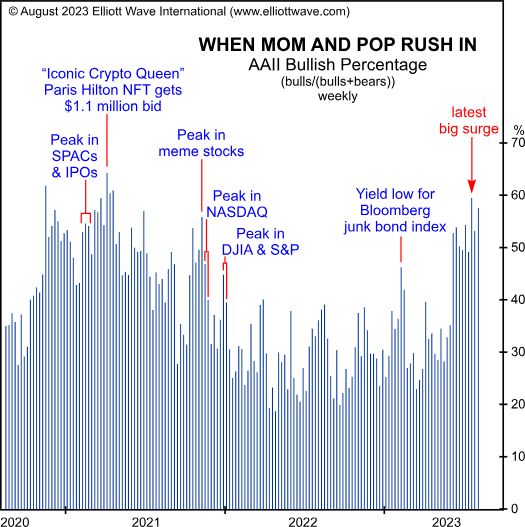

Here’s an interesting chart and commentary from the August 2023 Elliott Wave Financial Forecast:

This chart shows a jump in the AAII bullish percentage to 59.5% on July 21. … These mom-and-pop investors are traditionally cautious, so big moves and extreme readings generally reflect important capitulations.

Let me emphasize again that sentiment indicators are important yet you may not want to use them for market timing.

That said, when you combine time-tested sentiment indicators with Elliott wave analysis, you get a much clearer picture.

If you’re unfamiliar with Elliott wave analysis, read Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

When after a while the apparent jumble gels into a clear picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so.

Our friends at Elliott Wave International are sharing with you a special free report ($80 value).

Using 5 must-see charts, “Are Bulls Headed for a Rude Awakening? 5 Market Warning Signs — Revealed” focuses your readers’ attention on 5 key sentiment areas:

- Foreign stock buyers’ behavior: a red flag

- See what the crowd’s attitude towards tech stocks shows

- Tech stocks vs broad equities: What’s the message here?

- Corporate insiders — are they buying or selling?

- Artificial intelligence: See what previous technology fevers signaled

Read “5 Market Warning Signs — Revealed” now, FREE ($80 value) >>

P.S. From the inverted U.S. Treasury yield curve to the second-largest U.S. bank failure in history (care of the March Silicon Valley bank collapse) — 2023 has been a year of eerie callbacks to the 2008 financial crisis. See what the rest of the year is likely to bring via our special report >>