Inflation / Deflation and Credit Bubble

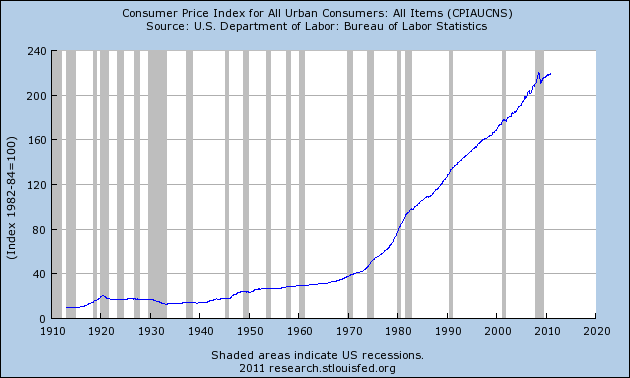

Since the FED was created in 1913, it has been inflating credit. This credit expansion has accelerated since 1980s. The resulting credit bubble is now in the process of busting since 2007.

For an investor, it is important to know the effects of this credit expansion. It has fueled the stock market bubble of 1980s and 1990s. It has fueled the greatest housing bubble in history of mankind. It has fueled the consumer economy in the US.

When the expansion of credit stops, it’s effects are rolled back. It will feel like a decrease in total money supply. Less money will be chasing an over supply of goods and services. Prices compared to US dollar will have to fall. That is called deflation. We already saw this in stocks, housing, commodities after 2007.

Are We in Another Credit Bubble? And Is It Different than Before?

Whatever your politics, creed or nationality — we can all agree that a huge catalyst for the 2008-9 global financial meltdown was the universal binge of bad credit.

A huge part of that bad-debt pile were the “don’t-ask-don’t-tell” high-yield bonds — a.k.a. junk bonds — which were used to fund a lot of things, including corporate takeovers.

You might still remember how, at the time, few saw any reason to question the upside potential of these lower-grade yet higher-yielding loan instruments. Here, the following articles from 2007 recapture the scene:

“We’re in the thick of a period when debt is a good thing rather than a bad thing, at least in the corporate world. And the riskier the debt, the more investors want it. There is a self-sustaining cycle at work here. The global economy has been so strong in recent years that few companies, even those loaded with debt, have had trouble paying their obligations.” (LA TIMES)

“We say it isn’t politically correct to call them junk bonds anymore. There’s not a lot of downside risk because money managers burned in the dotcom era learned their less and portfolios aren’t as risky as 10 years ago.” (Associated Press)

The ensuing credit implosion systematically restored the political correctness of the word “junk,” as high-yielding bonds plummeted in the worst debt crisis since the Great Depression.

Which brings us to the trillion-dollar question: What about now? Or, expanded in a handy bullet-point format, the same question may be phrased like this:

- Has the world’s leading economy learned its lesson?

- Is the thirst for yield less than the need for caution?

- Is the credit health of the United States different than before?

- Is it different this time?

Well, the following chart from Elliott Wave International’s May 2015 Elliott Wave Financial Forecast shows you that — yes! The credit bubble underway in the United States today is different than the one that triggered the 2008-9 crisis.

It’s bigger.

“While the total value of investment-grade bond issuance surpassed $1 trillion in each of the last three years, the junk bond total more than doubled from the prior high in 2006 to more than $300 billion.

“‘Back in 2006/2007, 28% of debt being issued was B-rated,’ says hedge-fund manager Stanley Druckenmiller. Today 71% of the debt that’s been issued in the last two years is B-rated. So, not only have we issued a lot more debt, we’re doing so with much [lower standards].

“The quantity and quality of bond issuance over the last three years signals the potential for a credit washout that is even more severe than that of 2008/2009.”

Our new, May Financial Forecast goes on to explain why it is so with an equally shocking chart of U.S. consumer credit since 1980.

You can see that second chart in part 1 of our brand-new, 3-part report titled

“Credit Insanity: The Biggest Debt Bomb in History and the Fuse is Lit.”

Credit Insanity: The Biggest Debt Bomb in History and the Fuse is LitCreated for paying subscribers and now accessible to the public for the first time, this eye-opening new report reveals the precarious consumer, corporate and government debt situation around the world. Read this three-part report now and hear directly from the top analyst at the world’s largest financial forecasting firm about key research, statistics and concerns about U.S. and global debt, as well as its imminent threats to investors. |

This article was syndicated by Elliott Wave International and was originally published under the headline Are We in Another Credit Bubble? And Is It Different than Before?. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Why is the economy struggling?

You may think deflation is not a threat now. After all FED has printed money and injected into the economy, right? Not exactly. There is not enough political will to print money when economy seems to be OK. But the will to print appears AFTER deflation hits. In a deflationary crash, even though FED makes credit easier, it is hard to turn the boat around due to the following reasons:

1. Lenders (banks) do not want to lend because they think they may not get their money back. This is because the money supply is shrinking rapidly. All prices around you were based on inflated bank credit. People borrowed and bought things and inflated prices along with salaries. It is very possible that all prices and salaries can be cut in half if the money supply shrinks 50%. Then it will be very hard to pay back a fixed rate loan.

2. Borrowers do not want to borrow because they think they may not be able to pay it back. This is normal because people see job cuts, companies cut costs, prices fall, so how can they be sure that they will make same salary in the future to pay back what they owe.

3. For price inflation to happen, people must have a lot of money to chase too few products. We have that in housing in some areas where supply is tight. But in other areas what we have now is the opposite. We have wage reduction. We have high debt levels. We have excess capacity producing too many products. The supply exceeds the demand. The prices will fall, not go up. All companies are selling less, good results are just a result of cost cutting. When one company does it, it is good. But when all companies do it, cost cutting is detrimental to the economy. Earnings will go lower. Imagine an IT company produces software and hardware, but cuts costs: layoff workers, freeze salaries, stop investments. Their customer is a bank. If the bank cuts costs what will they do? They will say: Hey we are not buying new software from this IT company this year. We will run with fixer upper systems we have, sorry. This mentality will effect everyone’s earnings! It may sound good for the bank, but it is bad for the IT guy. There is a chain reaction.

Almost all of the money supply in the economy is in terms of bank credit. This monetary system is prone to a deflationary crash. There is a herd effect in the population. People borrow and spend altogether and they stop borrowing altogether. This creates cycles like kontradiev wave. The herd effect causes great booms and great busts. This is explained in Conquer the Crash.

Conquer the Crash foresaw the financial crisis back in 2002 and explained in detail how it would unfold. It is like a history book about the future. Must read.

From a long term investing perspective, it is imperative that we the investors time the market and allocate our assets accordingly to avoid the devastating effects of a deflationary collapse.

Discover The Biggest Threat To Your Money Right Now

If inflation is a quiet thief, then deflation is an armed burglar. You wouldn’t invite either into your home, yet chances are that one of the two is stealing your money right now.

Elliott Wave International, the world’s largest market forecasting firm, has just released a free report that reveals which of these threats you should prepare for right now.

The free 8-page report is adapted from Bob Prechter’s New York Times best-seller, Conquer the Crash, which was published far before the latest headlines warned of inflationary and deflationary dangers.

With 2008 – 2011 consumer prices plunging at a record rate not seen in more than 6 decades, now is hardly the time to ignore Prechter’s prescient message of how to survive and prosper in the today’s market environment.

Protect yourself and your loved ones.

Visit Elliott Wave International to Download Your Free Report on Inflation and Deflation.

Here is Consumer Price Index for all items:

|

Deflation Survival Guide

By Elliott Wave International

Telegraph.go.uk, May 26, 2010: “US money supply plunges at 1930s pace… The M3 money supply in the U.S. is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history.”

|

Deflation is suddenly in the news again. It’s a good moment to catch up on a few definitions, as well as strategies on how to beat this rare economic condition.

And who better to ask than EWI’s president Robert Prechter? He predicted the first wave of deflation in the 2007-2009 “credit crunch” and has written on this topic extensively.

We’ve put together a great free resource for our Club EWI members: a 63-page “Deflation Survival Guide eBook,” Prechter’s most important deflation essays. Enjoy this excerpt — and for details on how to read the eBook in full free, look below.

What Makes Deflation Likely Today?

Following the Great Depression, the Fed and the U.S. government embarked on a program…both of increasing the creation of new money and credit and of fostering the confidence of lenders and borrowers so as to facilitate the expansion of credit. These policies both accommodated and encouraged the expansionary trend of the ’Teens and 1920s, which ended in bust, and the far larger expansionary trend that began in 1932 and which has accelerated over the past half-century. Other governments and central banks have followed similar policies. The International Monetary Fund, the World Bank and similar institutions, funded mostly by the U.S. taxpayer, have extended immense credit around the globe.

Their policies have supported nearly continuous worldwide inflation, particularly over the past thirty years. As a result, the global financial system is gorged with non-self-liquidating credit. Conventional economists excuse and praise this system under the erroneous belief that expanding money and credit promotes economic growth, which is terribly false. It appears to do so for a while, but in the long run, the swollen mass of debt collapses of its own weight, which is deflation, and destroys the economy. A devastated economy, moreover, encourages radical politics, which is even worse.

The value of credit that has been extended worldwide is unprecedented. Worse, most of this debt is the non-self-liquidating type. Much of it comprises loans to governments, investment loans for buying stock and real estate, and loans for everyday consumer items and services, none of which has any production tied to it. Even a lot of corporate debt is non-self-liquidating, since so much of corporate activity these days is related to finance rather than production.

Figure above is a stunning picture of the credit expansion of wave V of the 1920s (beginning the year that Congress authorized the Fed), which ended in a bust, and of wave V in the 1980s-1990s, which is even bigger.

…it has been the biggest credit expansion in history by a huge margin. Coextensively, not only is there a threat of deflation, but there is also the threat of the biggest deflation in history by a huge margin. …

Read the rest of this important 63-page deflation study now, free! Here’s what you’ll learn:

- What Triggers the Change to Deflation

- Why Deflationary Crashes and Depressions Go Together

- Financial Values Can Disappear

- Deflation is a Global Story

- What Makes Deflation Likely Today?

- How Big a Deflation?

- Much, Much More

Deflation and Fiat Currency

Part 1:

Part 2:

Part 3:

Deflation eBook

- Get Robert Prechter’s FREE 60-Page Deflation Survival Guide

- With you in mind, financial analyst Robert Prechter scoured thousands of pages of his warnings and teachings about deflation. He then handpicked his most important deflation writings and compiled them into a special, unedited, 60-page Deflation Survival Guide. If you haven’t yet given Prechter’s deflation argument your full attention, you should know now that yesterday was the best time to do so. Download Your 60-page Deflation Survival Guide Now FREE.

Our friends at Elliott Wave International put together an expansive Deflation Survival Guide. The free 60-page eBook is packed with Robert Prechter’s most important teachings and warnings about deflation. This is one of the most valuable resources EWI has ever offered at no cost. Learn more below or download it now for free.

- We want to tell you about a financial analyst who’s made the journey from fame to outcast and back. We want to tell you about the man who successfully forecast today’s investment environment when virtually everyone, everywhere said he was wrong.

- Please allow me to share with you a quote from a popular journalist of the early 1900s, Kin Hubbard:

- “There’s no secret about success. Did you ever know a successful man who didn’t tell you about it?”

- To that, we reply, “Would you have ever benefited from his success if he hadn’t?”

- The irony about this quote, and success itself, is that the road to success is often littered with scores of detractors.

- They try to discredit your accomplishments.

- They try to disprove your research.

- Finally, once your mounting evidence forms a mountain too high to climb, they find a way to jump on your bandwagon.

- In 2002, when Robert Prechter released a book called Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression, an eventual New York Times, Wall Street Journal and Amazon best-seller, the detractors were out in full force.

- The elite financial community labeled Prechter – the 1980s “Guru of the Decade” – an outcast, a man preoccupied with the concerns of “small children.” Experts from all schools of the economics profession said Prechter’s deflationary scenario was “utter nonsense,” and as likely to happen as “being eaten by piranhas.”

- “It couldn’t happen!”

- “It never will!” they guaranteed.

- Yet … here it is. Since the real estate top in 2005, deflation has festered its way into almost all asset classes, ravaging the portfolios of millions. If you’ve been spared from deflation’s mighty jaws, you surely know someone who hasn’t.

- Steadfastly throughout the years, Prechter issued warning after warning about the coming deflation. He provided helpful tips to investors, students, homeowners and business people alike on how to survive the coming deflation. Those who heeded his warnings have kept themselves, their families and their money safe. Some even realized modest gains while others endured life-altering losses.

- If you haven’t yet given Prechter’s deflation argument your full attention, we write today to tell you that yesterday was the best time to do so.

Prechter’s complete writings on deflation literally fill thousands of pages. Now, for a limited time, Prechter has compiled his most important deflation writings into a special 60-page Deflation Survival Guide. - Until today, most of the forecasts and advice in this still-prescient eBook have only been released to Prechter’s faithful subscribers. You will not find its entire contents in other books or from other sources. This is your FREE definitive Deflation Survival Guide.

- Download your 60-page Deflation Survival Guide now

|

Are we starting another Great Depression?

Credit / Debt Bubble

Ellen Brown explains how the banks create money of out thin air and how this causes inflation and deflation.

Part 1:

Part 2:

Part 3:

Part 4:

Part 5:

Robert Prechter explained how this system would crash in his 2002 bestseller book “Conquer the Crash”. 2nd edition was released October 2009 and updates the deflationary crash scenario based on latest developments.