Global Investing: Here’s the Message of Consumer “Overconfidence”

Bear markets tend to follow this particular sentiment.

In many global regions, economies are flourishing.

For example, here are two headlines about the U.S.:

What America’s Startup Boom Could Mean For The Economy (npr.com, June 29)

Inflation Rose in June as Economic Recovery Continues (WSJ, July 13)

The goings-on in the United Kingdom provide another example. Employers in the UK are hiring people at the highest rate in more than six years. Plus, business and consumer spending are climbing swiftly — at the fastest clip in a quarter of a century.

So, it wasn’t surprising to see this June 18 CNBC headline:

Morgan Stanley picks the global stocks set to ride Europe’s expected boom

However, here’s what investors need to know: An economic boom follows an uptrend in the stock market, not the other way around. In other words, history shows that a booming economy may serve as a contrarian indicator.

Indeed, here’s a chart and commentary from our July Global Market Perspective, a monthly Elliott Wave International publication which provides forecasts for 50+ worldwide financial markets:

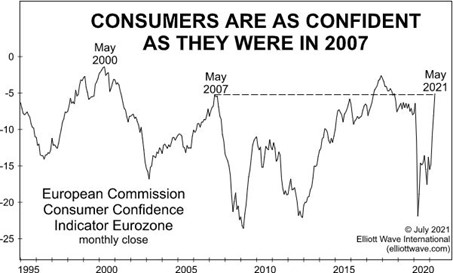

The chart shows that consumer confidence in the European Union two months ago eclipsed the survey’s pre-pandemic optimism from February 2020. Financial markets have traveled this territory before. In May 2020, GMP discussed two prior outbreaks of consumer overconfidence and noted that bear markets followed such sentiment. In the case of this survey, the all-time high came in May 2000.

The Stoxx 600 peaked in March of that year and fell 60% over the next 24 months. Consumer confidence peaked two months before the stock market’s top in July 2007, and the Stoxx 600 declined 61% to March 2009.

Yes, consumer and business confidence might climb even higher. However, the point is: The “boom part of the cycle” appears to be in the “mature” zone. Another key takeaway is that many in the investment community see the economic upturn as a sign that the bull market in stocks will persist when history suggests just the opposite.

The best way to get a handle on the world’s stock markets is to use the Elliott wave model, which reflects the repetitive patterns of investor psychology.

After all, as Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior notes, “The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.”

Want to see (FREE) what the waves are predicting next for

50+ of the biggest global markets?

Stocks in the U.S., Asia and Europe; bitcoin + other cryptos, bonds, FX, gold, oil… now through August 6, join us at Elliott Wave International for a free investor event, “Around the World in 19 Days.”

It’s our main event of 2021 — this journey takes you around the world’s 50+ most active markets in 19 enlightening days.

FREE, join in now to see new forecasts instantly ($245 value).

August 21 Update:

Why a Global Fund-Manager Favorite May Start to Flounder

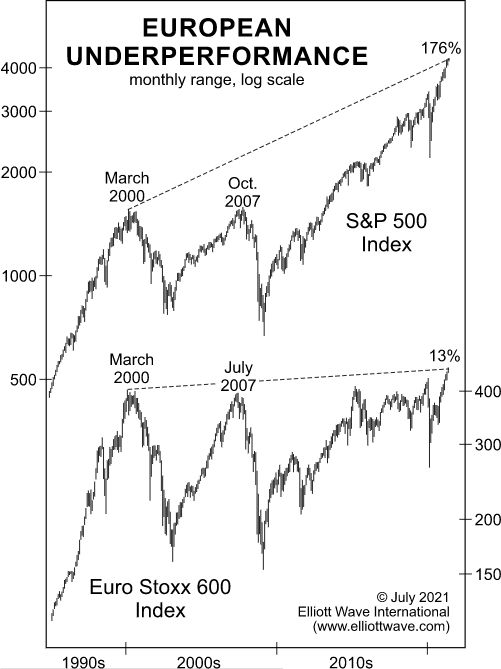

This chart shows a “dramatic divergence” between U.S. and European stocks.

Cryptocurrencies and so-called meme stocks have certainly received a lot of attention from investors.

Another investment category that has been in favor recently is European equities. No, they may not be quite as “hot” as, say, bitcoin — but they’ve been receiving more attention than usual.

Let’s start with some recent headlines:

- U.S. investors are pouring money into European stock funds (Marketwatch, May 27)

- European Stocks Are Coming In From the Cold (Bloomberg, June 17)

- It’s a Good Time to Invest in Europe (Kiplinger, June 24)

The July Global Market Perspective, an Elliott Wave International monthly publication which provides coverage of 50+ worldwide financial markets, offers more insight:

According to a June survey by Bank of America, more than a third of global fund managers are overweight eurozone equities, their highest exposure to Europe since 2018.

So, is it time to jump on the European equities’ bandwagon?

Well, let’s return to the July Global Market Perspective for the big picture. Here’s a chart and commentary:

[It’s] true. The Euro Stoxx 50 has handily beaten the S&P 500 in dollar terms this year. However, take a look at this stunning chart showing the dramatic divergence between the two regions over the past two decades.

The price patterns of the main stock indexes of two of the region’s largest economies are also highly revealing.

The July Global Market Perspective provides detailed Elliott wave analysis of Germany’s DAX and Britain’s FTSE 100 which every global investor should review. Both indexes have reached critical junctures.

Also see charts of three European meme stocks — and, get analysis of cryptocurrencies, forex, bonds, metals, energy and much more — all in all, coverage of 50+ worldwide financial markets.

It’s all inside the July Global Market Perspective, which you can access for free by joining Elliott Wave International’s Global Market Perspective Gala FreePass Event, which runs from now through August 6.

Here’s another quote from the July Global Market Perspective:

In a broad benchmark of U.S. stocks known as the Russell 3000 Index, there are 726 companies whose earnings don’t cover their interest payments, a red flag to pros. These zombies are up an average of 30% in 2021 — trouncing the 13% return for the whole index — 41 have doubled since New Year’s eve.

Even explicitly dire warnings don’t seem to register. A bankruptcy plan under consideration by GTT Communications Inc. would wipe out shareholders, which is typical in Chapter 11 cases. Nevertheless, the company’s stock is up about 69% since then.

Defiance of warnings is a trait of retail investors.

Continue to read our global financial analysis so you can prepare for major global financial shifts that will likely take most global investors by surprise.

Just follow this link: Elliott Wave International’s Global Market Perspective Gala FreePass Event (now through August 6).