US trade deficit is lower for the past year and the government is trying hard to further lower it. Deficit cannot be maintained forever so we have to do something about it and the government is motivated. It makes sense to have a balanced trade for the overall economy. But is that something to celebrate for the stock market? Do the stocks go up when there is less deficit?

Is Lower Trade Deficit Bullish For the Stock Market?

U.S. trade gap narrowed in April, and many will see that as a bullish sign

This Chart Provides Answers

- “The Dow rose nearly 1 percent Thursday… Investors were encouraged by a report that the United States trade deficit had narrowed, one positive point in a recent string of weak economic data.” (June 9, 2011, Reuters)

Before you join the crowd in thinking that shrinking trade gap is bullish for stocks, read this excerpt from the 2011 edition of our popular free Club EWI resource, The Independent Investor eBook.

*****

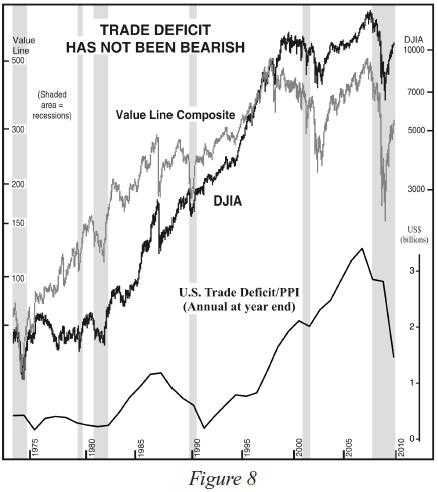

Over the past 30 years, hundreds of articles — you can find them on the web — have featured comments from economists about the worrisome nature of the U.S. trade deficit. It seems to be a reasonable thing to worry about. But has it been correct to assume throughout this time that an expanding trade deficit impacts the economy negatively? Figure 8 answers this question in the negative.

|

In fact, had these economists reversed their statements and expressed relief whenever the trade deficit began to expand and concern whenever it began to shrink, they would have accurately negotiated the ups and downs of the stock market and the economy over the past 35 years. The relationship, if there is one, is precisely the opposite of the one they believe is there. Over the span of these data, there in fact has been a positive — not negative — correlation between the stock market and the trade deficit.

It is no good saying, “Well, it will bring on a problem eventually.” Anyone who can see the relationship shown in the data would be far more successful saying that once the trade deficit starts shrinking, it will bring on a problem. Whether or not you assume that these data indicate a causal relationship between economic health and the trade deficit, it is clear that the “reasonable” assumption upon which most economists have relied throughout this time is 100% wrong.

Around 1998, articles began quoting a minority of economists who — probably after looking at a graph such as Figure 8 — started arguing the opposite claim. Fitting all our examples so far, they were easily able to reverse the exogenous-cause argument and have it still sound sensible. It goes like this: In the past 30 years, when the U.S. economy has expanded, consumers have used their money and debt to purchase goods from overseas in greater quantity than foreigners were purchasing goods from U.S. producers. Prosperity brings more spending, and recession brings less. So a rising U.S. economy coincides with a rising trade deficit, and vice versa. Sounds reasonable!

But once again there is a subtle problem. If you examine the graph closely, you will see that peaks in the trade deficit preceded recessions in every case, sometimes by years, so one cannot blame recessions for a decline in the deficit. Something is still wrong with the conventional style of reasoning.

*****

All you need is to create a free Club EWI profile. Here’s what else you’ll learn:

- · Why QE2 was a major tactical error

- · Why interest rates don’t drive stock prices.

- · Why rising oil prices are not bearish for stocks.

- · Why earnings don’t drive stock prices.

- · What inflation has to do with the prices of gold and silver

- · Why central banks don’t control the markets.

- · Much more — 51 pages in all

- Keep reading the free Independent Investor eBook now — all you need is a free Club EWI membership.