Editor’s note: This article is excerpted from “The State of the Global Markets 2015 Edition,” a comprehensive report by Elliott Wave International, the world’s largest independent market-forecasting firm (data through December 2014). You can download the full, 53-page report here — 100% free.

In its November issue, published on Oct. 31, EWI’s European Financial Forecast discussed the plunging 5-year/5-year forward swap, a market-based gauge that measures inflation expectations from five years to 10 years out, and stated, “Even the central bank’s preferred inflation metric shows nothing but flat or falling prices over the foreseeable future.”

In November, a “sharp deterioration in sentiment” (WSJ, 11/17/14) popped up in the economic surveys.

According to a poll conducted by Germany’s IW Economic Institute, nearly one quarter of the 2,900 companies surveyed (almost double the percentage from last spring) plan to cut investments in 2015. Likewise, the percentage of companies planning to increase spending fell from 44.1% to 29.8%.

In fact, the more officials seem to push the story of a great global recovery, the harder the deflationary evidence seems to push back.

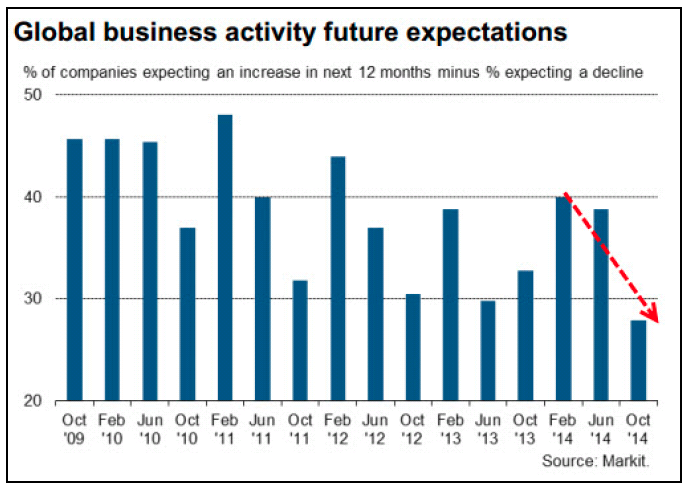

Notice that the balance of companies expecting to increase business activity in the next 12 months just fell to its lowest level since the survey began five years ago.

Markit’s accompanying analysis presents many more lowlights (emphasis added):

Worldwide

- Expectation of business activity weakened among both manufacturers and service providers.

- Hiring and investment plans rest at post-crisis lows.

- Price expectations deteriorated further.

- Optimism in manufacturing fell to its lowest since mid-2013, while optimism in services slumped to the lowest in the survey’s five-year history.

In the United States

- “The most striking development was the extent of the downturn in the U.S., where optimism hit a new survey low, with the service sector seeing a particularly dramatic decline.”

In Europe and Emerging Markets

- Business confidence in Spain and Italy was the lowest recorded since this time last year.

- In Germany and France, confidence was far lower … with both ‘core’ countries seeing the lowest levels of optimism since June of last year.

- Business expectations across the main emerging markets fell on average to the lowest seen in the survey’s five-year history.

To be clear, deeply rooted economic pessimism often precedes a low in stocks and social mood. But what exists today is something quite different: Namely, investors display excessive optimism toward stocks, while economic fundamentals only continue to deteriorate. We have noted, for example, that J.P. Morgan equity strategists just upgraded European stocks from underweight to overweight, believing that the region is “due a period of outperformance vs. the U.S.” (Reuters, 11/17/14) Yet, economists at J.P. Morgan just downgraded its GDP forecast, calling for world growth to come in at 2.6%. The International Monetary Fund likewise cut its forecast for global growth — for the sixth time in less than two years. At 3.3%, world growth will fall from 3.6% a year ago and from 4.1% a year before that.

We simply don’t buy any of these projections. The critically stretched position of the world’s major stock markets calls for economic downgrades to persist until the worldwide economy enters another full-blown contraction, which is likely sometime in 2015.

Editor’s note: This article is excerpted from “The State of the Global Markets 2015 Edition,” a comprehensive report by Elliott Wave International, the world’s largest independent market-forecasting firm. For a limited time, you can download the full report, for free, and use its year-in-preview insights to prepare, survive and prosper through the global investment landscape of 2015 and beyond. Download the full, free, 53-page report here.