After decades of deflation in Japan, we thought there was hope and the deflating money supply and falling prices were gone. But during the last two quarters we once again witnessed relentless deflationary pressure in Japan despite record stimulus that promised inflation. Well, inflation is missing in action. Deflation still rocks the nation! Surprised?

Why the biggest monetary stimulus effort in the world did NOT stop deflation in its tracks

When Shinzo Abe became the Prime Minister of Japan in December 2012, he was regarded with the kind of reverence that politicians dream about. He was featured in a hit pop song (“Abeno Mix”), hailed as a “samurai warrior,” and featured on the May 2013 The Economist cover as none other than Superman.

But in the two short years since, Abe as Superman has been struck down by the superpower-zapping force of economic kryptonite. On November 17, government reports confirmed that Japan’s brief respite from a 20-year long entrenched deflation was over as the nation’s 2nd & 3rd quarter GDP shrank 7.2% and 1.6% respectively.

In the words of a November 20, 2014 New York Times article:

“I’d say it’s time to call Abenomics a failure. All that is left is disappointment.“

Why did Abenomics fail? That’s the one question “being asked in a shell shocked Japan,” observes the same New York Times piece.

Their shock is understandable. Shinzo Abe spearheaded the boldest and biggest economic stimulus campaign to revive growth and reduce debt not just in Japan’s history, but in the world’s. To give you an idea of its magnitude, consider this:

Abe greenlit daily quantitative easing interventions by the Bank of Japan equivalent to $15 billion per day.

— VS. —

At its peak, the U.S.’s QE program authorized “only” $85 billion a month.

Japan’s QE was three times larger than the Fed’s! According to the mainstream analysts, there was no way the strategy could fail:

“With Abenomics, Japan Catches a Sense of Revival… The architect of this resurgence is Prime Minister Shinzo Abe. His plan reflects a breadth of vision and coordination that no leader until Abe seemed interested in.” (Washington Post, May 24, 2013)

But, despite its historic size and the widespread faith in its success, Elliott Wave International’s team of analysts foresaw an entirely different outcome — namely, Abenomics would not be the alchemical instrument of economic change:

January 22, 2013: The Bank of Japan ups its inflation target rate to 2% and makes an “open-ended commitment to buy assets until the target is in sight.”

February 2013 Elliott Wave Financial Forecast: “In the area of central bank intervention, the ‘juice’ continues to flow… The effort to escape gravity illustrates just how detached central bankers remain from the reality that their efforts are imprudent, unfair, and doomed to fail.”

February 2013: Abenomics is hailed as the catalyst for the yen’s collapse.

March 2013 Asian Pacific Financial Forecast: “Most conventional observers are convinced that Japanese Prime Minister Abe’s New Liberal Democratic Party (LDP) administration has caused the yen to plunge… simply by promising to do whatever it takes to stop Japan’s deflation.”

“Conventional observers are just doing what they always do: looking back to around the start of a financial trend, finding a significant event from around that time… and then assuming that the event caused the trend.”

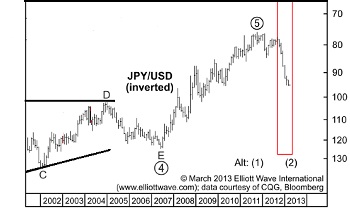

Chart of JPY/USD shows, however, that the yen completed a large-degree fifth wave in November 2011, one year BEFORE Abe even took office!

May 18, 2013 The Economist cover of Abe as superman writes: “Mr. Abe is electrifying a nation that had lost its faith.”

May 2013 Elliott Wave Financial Forecast: “Faith in the power of central banks to stem the ebbing tide of [deflation] remains strong. Ultimately, however, all of these efforts will fail.”

June 2013 Elliott Wave Financial Forecast: “As Japan’s economy teetered, Japanese Prime Minister Shinzo Abe instituted an unprecedented spending and monetary easing scheme despite a gross public debt that projects to a whopping 230% of GDP. It follows at least a dozen prior ‘stimulus’ efforts all of which failed. This effort is simply larger, so it will prove to be an even more spectacular failure.”

It’s been 2 year since Abenomics began, and the November 20 New York Times article confirms “its failure.” Since its inception:

- Japan’s government debt has increased to 250% of GDP

- The index of Japanese industrial output is 96.8, the exact same reading as 1989

- Real household income has fallen by 6%

- And Japan has an 11 trillion yen trade deficit –vs.- a 5 trillion yen trade surplus in 2010

Now, EWI’s educational resource team has put together a new, free report titled “What You Need to Know Now About Protecting Yourself From Deflation” that explains why—

“The psychological aspect of deflation and depression cannot be overstated. When the social mood trend changes from optimism to pessimism, creditors, debtors, producers and consumers change their primary orientation fromexpansion to conservation. As creditors become more conservative, they slow their lending. As debtors and potential debtors become more conservative, they borrow less or not at all… These behaviors reduce the velocity of money, the speed at which it circulates to make purchases, thus putting downside pressure on prices. These forces reverse the former trend.”

A deflationary psychology has been entrenched in Japan for the last 20 years. It is now arriving in Europe. You will be inundated by news reports from all four corners of the globe on deflation’s progress, and what the world’s monetary authorities are doing to ensure it will remain a temporary, contained and manageable event.

The worst thing you could do is rest on their promises.

Our new, 11-page report “What You Need to Know Now About Protecting Yourself From Deflation” is 100% free. It takes your understanding of this complex economic shift to a radical level AND gives you the ultimate advantage of knowing how to thrive during economic downturns.

The best part is, the entire report is now available to you free — simply by joining Club EWI and its rapidly expanding community.Go ahead and click here for instant access!

This article was syndicated by Elliott Wave International and was originally published under the headline Abenomics: From Faith to Failure. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.