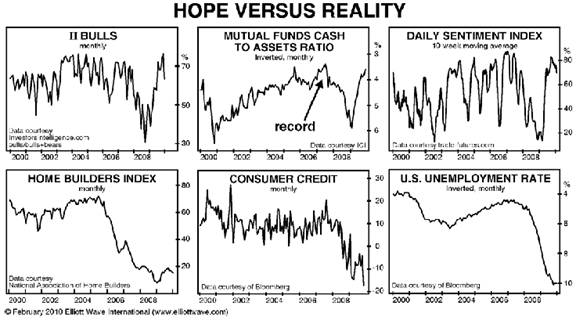

| Mainstream media has been beeting the drums and announcing that recession is over. According to the experts recovery is well in progress. 3% GDP growth is expected in the near future. Virtually nobody sees going back to the March lows in the stock market. Let us put some cold water on this heated enthusiasm and READ MORE |

Category: Economy

Discussion about the state of the economy, social mood, economic signals and their relation to market tops and bottoms.

Shrinking Business During Deflation

| A Better Way To Handle a Shrinking Business This article is part of a syndicated series about deflation from market analyst Robert Prechter, the world’s foremost expert on and proponent of the deflationary scenario. For more on deflation and how you can survive it, download Prechter’s FREE 60-page Deflation Survival eBook, part of Prechter’s NEW READ MORE |

The Last Bastion Against Deflation: The Federal Government

| The Last Bastion Against Deflation: The Federal Government This article is part of a syndicated series about deflation from market analyst Robert Prechter, the world’s foremost expert on and proponent of the deflationary scenario. For more on deflation and how you can survive it, download Prechter’s FREE 60-page Deflation Survival eBook, part of Prechter’s NEW READ MORE |

Deflationary Environment

| Making Preparations and Taking Action in Today’s Deflationary Environment Editor’s Note: The following article is adapted from Robert Prechter’s 2002 best-selling book, Conquer the Crash – You Can Survive and Prosper in a Deflationary Depression. In addition to this article, visit Elliott Wave International to download the free 15-page report about how to protect yourself, READ MORE |

About Financial Crisis

| Editor’s Note: This article has been excerpted from a free issue of Robert Prechter’s monthly market letter, The Elliott Wave Theorist. The full 10-page market letter, Be One of the Few The Government Hasn’t Fooled, can be downloaded free from Elliott Wave International. By Robert Prechter, CMT “Who Will Benefit From The Housing Act?” This READ MORE |

Price Effects of Inflation and Deflation

| Robert Prechter Explains the Price Effects of Inflation and Deflation Editor’s Note: On Nov. 19, 2008, the U.S. Labor Department reported a 1 percent drop in the consumer price index for October 2008. The drop marked the largest decline in 61 years, and it was the first decline in that measure in nearly a quarter READ MORE |

Banks Can Fail

| Why Your FDIC-Backed Bank Could Fail With big bank bailouts dominating the news, there’s no better time to get the truth about bank safety. This informative article has been excerpted from Bob Prechter’s New York Times bestseller Conquer the Crash. Unlike recent news articles that are responding to the banking crisis, it was published in READ MORE |

Cash is The King

| Has Cash Been King for the Past 10 Years? If you’re like most investors, you’ve been nearly brainwashed with conventional market “wisdom” that stocks are the best way to grow your portfolio. You would be crazy not to have your money in the markets, right? But when markets drop, as we’ve seen in this credit READ MORE |

Why Deflation

| The Primary Precondition of Deflation The following was adapted from Bob Prechter’s 2002 New York Times and Amazon best seller, Conquer the Crash You Can Survive and Prosper in a Deflationary Depression. Deflation requires a precondition: a major societal buildup in the extension of credit (and its flip side, the assumption of debt). Austrian economists READ MORE |

Government Does Not Want You To Ask About Financial Crisis

| 3 Questions The Government Doesn’t Want You To Ask About the Financial Crisis (And 3 Shocking Answers!) Bob Prechter, President of Elliott Wave International (EWI), is no stranger to challenging the status quo. His New York Times bestseller, Conquer the Crash, was published in 2002 before anyone was even talking about the current financial crisis. READ MORE |

How To Recognize a Financial Mania

| How To Recognize a Financial Mania When You’re Smack Dab in the Middle of One When you’re caught in the middle of a bad storm, you don’t really care whether it’s a tropical depression or a full-strength hurricane. You just know you’re hanging on for dear life. The same idea applies to financial markets. When READ MORE |