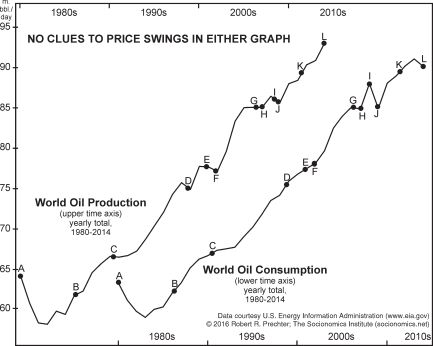

| Oil at $130: Look Beyond Supply and Demand “War” is the answer that only gets you so far Most everyone knows that oil and gasoline prices have been soaring, and this steady climb started well before the Russia-Ukraine conflict. The upward trend began in April 2020, when oil prices briefly went negative, and it’s continued READ MORE |

Category: Economy

Discussion about the state of the economy, social mood, economic signals and their relation to market tops and bottoms.

FDIC Guarantee?

| The Stunning Truth About the FDIC and Your Bank Deposits Why you can’t rely on the FDIC if another financial crisis hits and your bank goes under. Millions of U.S. bank depositors feel safe in the knowledge that the Federal Deposit Insurance Corporation will protect their accounts, even if their bank goes under. Yes, it’s READ MORE |

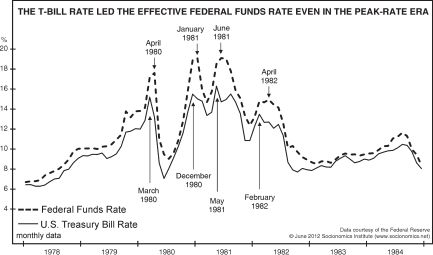

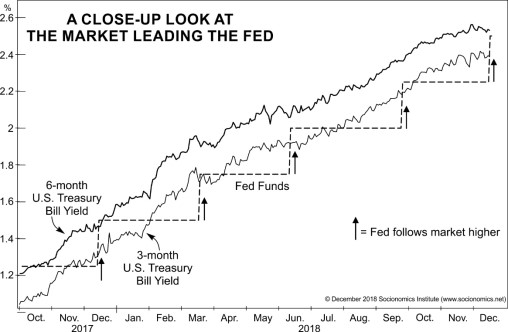

Fed Does Not Set the Interest Rates

| Here’s What Really Sets Interest Rates (Not Central Banks) See “powerful evidence that the Fed is not in control of interest rates” Most everyone is familiar with the phrase: “Keep your eye on the ball,” which of course means — focus on what really matters. Those who seek clues about the direction of interest rates READ MORE |

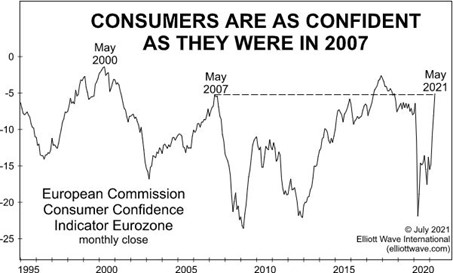

Booming Economy Requires Caution

| Global Investing: Here’s the Message of Consumer “Overconfidence” Bear markets tend to follow this particular sentiment. In many global regions, economies are flourishing. For example, here are two headlines about the U.S.: What America’s Startup Boom Could Mean For The Economy (npr.com, June 29) Inflation Rose in June as Economic Recovery Continues (WSJ, July 13) READ MORE |

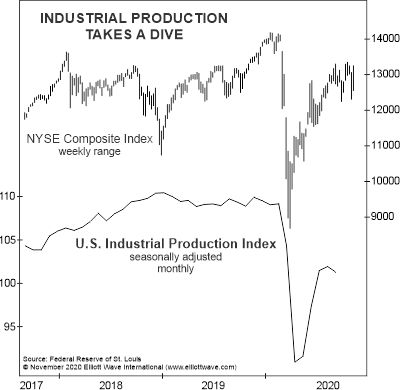

Warning Signs for the US Economy

| Look at These 2 Big Warning Signs for the U.S. Economy. Interestingly, this economic measure’s “retracement of the decline from February is a Fibonacci 61%”. The 7.4% GDP growth in Q3 notwithstanding, the evidence shows that the U.S. economy remains fragile. Let’s start off with this chart and commentary from the November Elliott Wave Financial READ MORE |

What’s next for the economy?

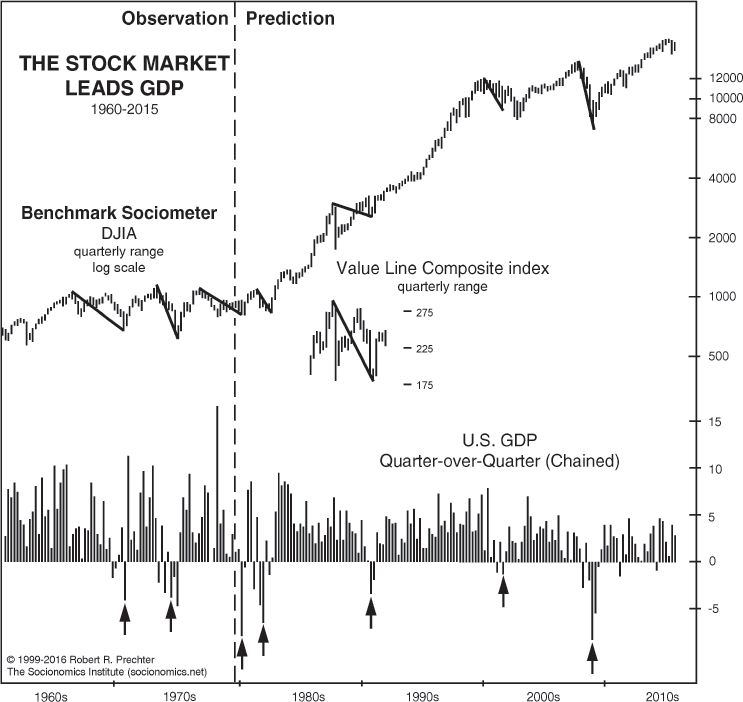

| There IS a way to forecast the general health of the economy. This method has repeatedly proven itself. Yes, you can anticipate the likelihood of a recession, even a depression — or, conversely, when major economic measures — like jobs — will be robust. That surefire way is the performance of the stock market. That’s READ MORE |

Interest Rates Win Again as Fed Follows Market

| Kendall and Hochberg: Interest Rates Win Again as Fed Follows Market By Elliott Wave International Most economists and financial analysts believe that central banks set interest rates. For more than two decades, Elliott Wave International has tracked the relationship between interest rates set by the marketplace and interest rates set by the U.S. Federal Reserve READ MORE |

The Biggest Stock Market Crash of Your Lifetime

| Warning: A stock market crash and a deflationary depression that may rival the Great Depression is in its early stages. Posted on November 21, 2018 by ElliottWave.com: There is evidence that deflationary forces are already taking hold in America By Murray Gunn When I was writing technical analysis reports for the customers of a major READ MORE |

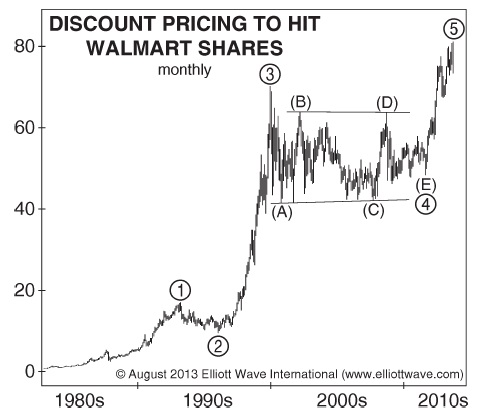

Where is Walmart Headed?

| Walmart stock has dived throughout 2015 and is up from lows in 2016. Will the up-run continue? The era of “always low prices” no longer translates into always high profits. Learn what we think is behind the shift By Elliott Wave International Walmart founder Sam Walton said: “There is only one boss. The customer. And READ MORE |

Free Elliottwave Theorist

| With the market action during the last few weeks, many investors have been operating in panic mode; subscribers to Robert Prechter’s Elliott Wave Theorist haven’t. Why? Because they were prepared. Elliott Wave International prepared them for the 2007-2009 crisis, and they did it again. In fact, in the calm of Aug. 18, Bob wrote a READ MORE |

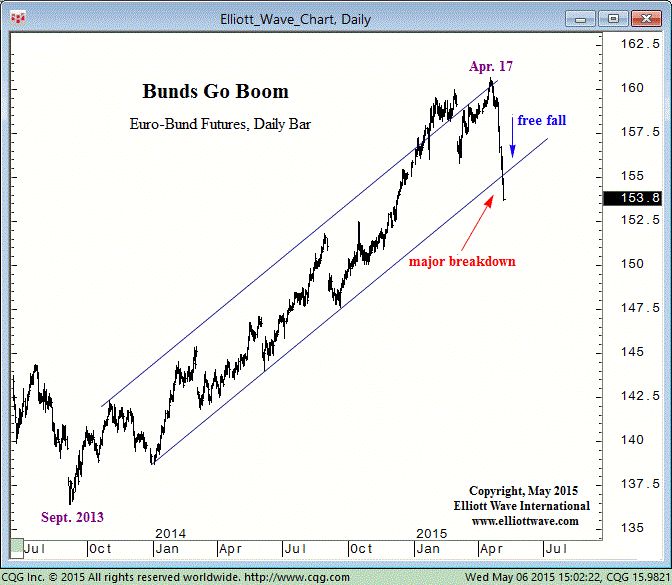

Volatility Shakes Bond Markets

| Is the debt bomb about to go off? The yields on U.S. Treasuries and European sovereign debt have risen sharply in a relative short time. Bond prices trend inversely to yields — which means debt portfolios have suffered substantial losses. From mid-April through May 6, yield on German 10-year bunds spiked 47 basis points. Yields READ MORE |

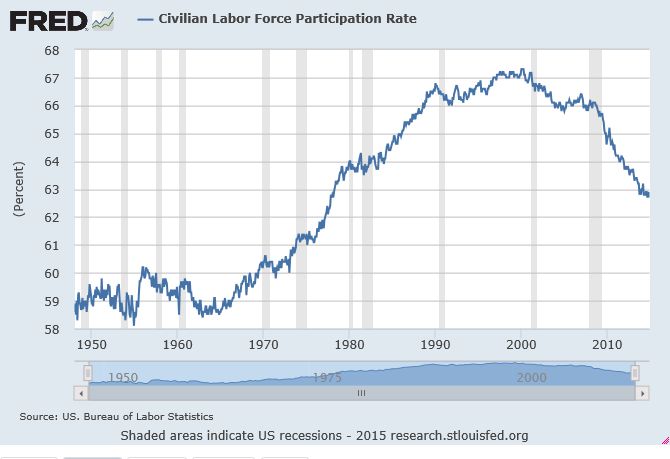

Is Unemployment Rate Really Getting Better?

| The “Big Lie” About the U.S. Jobs Picture Some 30 million people are either out of work or severely underemployed Get Your FREE Special Report: What You Need to Know NOW About Protecting Yourself from Deflation » The financial media heve been featuring stories with an upbeat outlook for the U.S. economy. For example: The READ MORE |

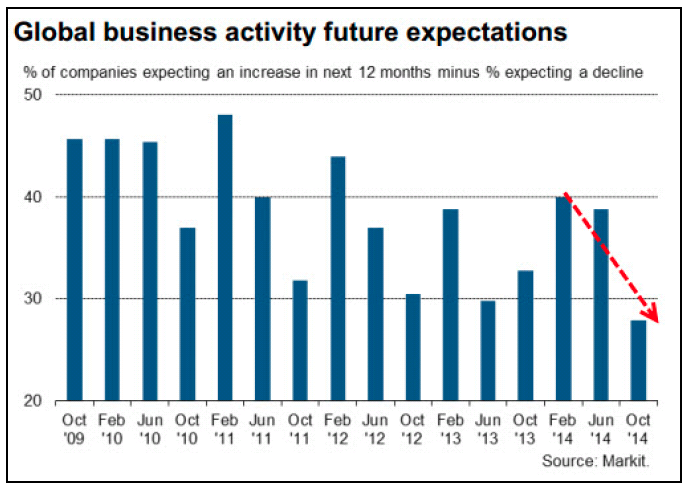

Why Expectations for Business Activity are Plunging

| Editor’s note: This article is excerpted from “The State of the Global Markets 2015 Edition,” a comprehensive report by Elliott Wave International, the world’s largest independent market-forecasting firm (data through December 2014). You can download the full, 53-page report here — 100% free. In its November issue, published on Oct. 31, EWI’s European Financial Forecast READ MORE |

From Faith to Failure: Abenomics

| After decades of deflation in Japan, we thought there was hope and the deflating money supply and falling prices were gone. But during the last two quarters we once again witnessed relentless deflationary pressure in Japan despite record stimulus that promised inflation. Well, inflation is missing in action. Deflation still rocks the nation! Surprised? Why READ MORE |

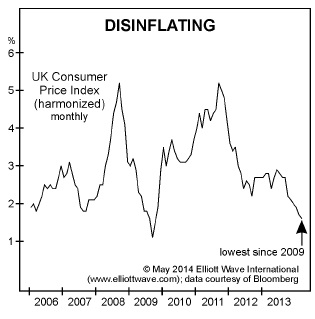

Can Europe’s Deflation Be Like Japan?

| While the stock market has recently seen all time highs in the the United States, despite Federal Reserve’s quantitative easing runs, inflation has been mute. In fact there is talk that FED may just keep printing money if deflation continues to be a concern! Across the ocean, money printing has continued for some years as READ MORE |